Budget

Budget

Arizona’s Revenue Problem Undermines Economic Performance

January 9, 2017Arizona’s Revenue Problem Undermines Economic Performance

Dave Wells, Ph.D.

Research Director, Grand Canyon Institute

Key Findings:

Arizona ranks last in economic performance among the 50 states over last two business cycles.

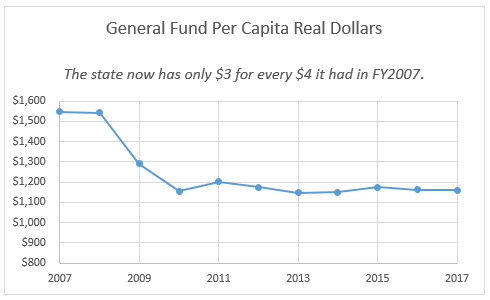

Controlling for population and inflation the state has only $3 for every $4 it had ten years ago, a 25% decline.

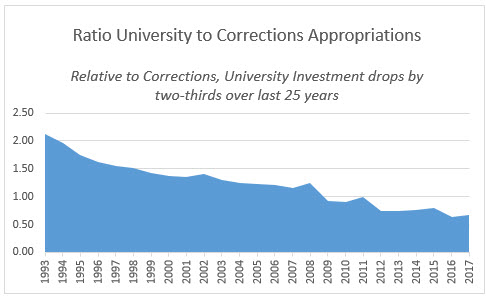

Per student funding to universities is half what it was ten years ago and over the last 25 years university spending has declined from being twice what was spent on corrections to corrections now spending exceeding universities by 50 percent.

The state’s support for vulnerable families is inadequate as the number of children in foster care has nearly doubled in the last six years.

Nearly $1 billion in K-12 education cuts since FY2007 were not impacted by Prop. 123.

These shortcomings are undermining the state’s economic performance.

Critical investments could nurture future growth.

Policy Brief

January 9, 2017

Arizona’s Revenue Problem Undermines Economic Performance

Dave Wells, Ph.D.

Research Director, Grand Canyon Institute

Key Findings:

Arizona ranks last in economic performance among the 50 states over last two business cycles.

Controlling for population and inflation the state has only $3 for every $4 it had ten years ago, a 25% decline.

Per student funding to universities is half what it was ten years ago and over the last 25 years university spending has declined from being twice what was spent on corrections to corrections now spending exceeding universities by 50 percent.

The state’s support for vulnerable families is inadequate as the number of children in foster care has nearly doubled in the last six years.

Nearly $1 billion in K-12 education cuts since FY2007 were not impacted by Prop. 123.

These shortcomings are undermining the state’s economic performance.

Critical investments could nurture future growth.

Policy Brief:

As the legislature moves into session next week, about $24 million of flexible dollars have been identified by the Joint Legislative Budget Council. The rest is accounted for. (http://www.azleg.gov/jlbc/housebudgetorientation120916.pdf).

For those driven to reduce the size of government, the current situation may be viewed as a success. However, an emerging and more prevalent view is that Arizona continues to run an austerity budget which falls far short of the needs. And that’s hindering our economic growth.

In August, the Grand Canyon Institute released a study on economic performance focusing on four elements:

Growth in Real State Gross Domestic Product Per Job

o a measure of productivity growth

o 2001-2014 (longer-term, the last two expansions)

o 2009-2014 (this expansion only),

Growth in Per Capita Personal Income Growth

o a measure of income growth

o 2001-2015 (longer-term, the last two expansions)

o 2009-2015 (this expansion only),

Unemployment rate (average of the U3 and U6 rate as captured over the last year), and

Gini Coefficient for Personal Income Growth from 2009-2014 (a measure of inequality)

Arizona ranked 50th and was the only state to be in the bottom 10 in all four categories .

Legislators need to begin to see a bigger picture of where they wish to take the state. The state needs to establish goals and then put in place the investments needed to reach those goals.

This issue brief looks at just a few areas centered around Gov. Ducey’s goal to have 60 percent of Arizonans with a higher education beyond high school by 2030 (http://tucson.com/news/local/education/ducey-s-goal-of-arizonans-with-higher-degrees-by/article_d6fb0081-a97a-5092-8ab8-153c23d9dbd0.html).

GCI’s study found that growth in the working age population age 25-64 with an Associate degree or higher strongly correlated with economic performance. Between 2005 and 2012, Arizona ranked 42nd in its growth of people in that age group with an Associate degree or higher. Currently less than 40 percent of this age group have an Associate Degree of higher.

Gov. Ducey has espoused a goal of having 60 percent of Arizonans with a higher education beyond high school by 2030. That requires providing an affordable pathway to reach that goal—and a good starting place would be improving state-support for community colleges and universities. Due to budget cuts in Gov. Ducey’s first year in office, community colleges in Maricopa and Pima County no longer receive any support from the state. In FY2007, they received 11 percent of their funding from the state. Arizona’s universities has been cut in half on a per student basis since before 2007 in real dollars (https://grandcanyoninstitute.org/wp-content/uploads/2017/01/GCIWomensFoundationReport-Supporting-Womens-Self-Sufficiency-FY2013-Update-Dec-2014.pdf). In FY2007 Universities received $945 million and in FY2017 it was $698 million, even though student enrollments have grown and that is making no adjustment for inflation. ABOR has asked that the state pay for half the cost of resident students. Right now the state is paying for about one-third the cost. Meanwhile corrections spending has surpassed it. Over the last 25 years, Arizona has gone from spending twice as much on universities as corrections to spending 50 percent more on corrections than universities.

Figure 1

Source: Joint Legislative Budget Committee, General Fund Operating Budget Spending, FY1979-2017

Estimated Cost to reach ABOR’s budget goal: $234 million ($78 million if done over three years). http://www.azleg.gov/jlbc/housebudgetorientation120916.pdf .

However, getting to college requires investments from birth through high school designed to improve the likelihood of student success.

Currently about 78 percent of Arizona students graduate high school within four years. If we would like to see that increase to 90 percent by 2030, where the best states already are, then we need to make investments designed to improve the likelihood of student success. (https://grandcanyoninstitute.org/arizonas-high-school-graduation-rate-rises-to-77-4-percent-study-finds-graduation-rate-highly-correlated-with-state-economic-performance/)

Below are areas that should be a prime focus for the legislature.

The most critical way to improve success is helping students who come from economically vulnerable families, as in Arizona their four-year high school graduation rate is approaching 70 percent. (http://new.every1graduates.org/wp-content/uploads/2016/05/civic_2016_full_report_FNL2-2.pdf)

One sign of weakness in Arizona has been the lack of support for vulnerable families with needed support services to reduce number of children in foster care (which has almost doubled since 2010).

Figure 2

Source: Semi-Annual Child Welfare Reports (averaged for each year). August count used for 2016 since last semi-annual report for 2016 not yet available.

Expand access to programs like the nurse-family partnership to support healthy family development (https://www.maricopa.gov/PublicHealth/programs/nfp )

Improving affordable childcare access for working families (see pages 31 and 32 http://azchildren.org/wp-content/uploads/2016/12/QA-Budget-and-Taxes-002.pdf )

Providing a $10,000 a year raise to caseworkers in the Dept. of Child Safety to improve recruitment and retention. (approx. cost $20 – $30 million)

Improving working conditions for K-12 teachers to improve recruitment and retention. A $10,000 raise would, for instance, cost about $600 million. (http://www.azcentral.com/story/news/politics/arizona-education/2017/01/04/arizona-education-funding-legislature/95267516/ )

In addition, the state is no longer living up to its obligations for school facilities under Roosevelt v. Bishop and consequently if the legislature risks being sued for noncompliance. The state needs to become pro-active and start funding building renewal and school construction.

In addition, cuts have been made to district additional assistance (formerly soft capital) and all-day Kindergarten since FY2007.

Non-restored Education Cuts since FY2007: (https://grandcanyoninstitute.org/a-fiscal-analysis-of-proposition-123-and-arizonas-underinvestment-in-k-12-education-an-essential-first-step-for-k-12-funding/ )

Current Gap: District Additional Assistance $352,000,000

All-Day Kindergarten $247,000,000

Building Renewal Funds $93,000,000

New School Construction $288,000,000

That a huge gap has emerged is not surprising since the total General Fund is still below its FY2007 level on a nominal basis-excluding adjustments for population and inflation. When those adjustments are made, then the General Fund has dropped precipitously since FY2007.

Fiscal conservatives at one time used to wish to keep growth in the state budget to inflation plus population growth. As can be seen in the graph below, even by that minimalist measure, the state only has $3 for every $4 ithad in FY2007.

Figure 3

Source: Joint Legislative Budget Committee figures divided by Census population estimates adjusted for changes in GDP Price deflator.

Obviously, the math doesn’t add up—which means Arizona does not have a spending problem but a revenue problem.

Already the state has $4 billion in less state revenue due to past tax cuts and another $119 million in corporate tax cuts are already set to be implemented in the coming fiscal year (https://grandcanyoninstitute.org/a-fiscal-analysis-of-proposition-123-and-arizonas-underinvestment-in-k-12-education-an-essential-first-step-for-k-12-funding/ and http://www.azleg.gov/jlbc/housebudgetorientation120916.pdf).

The state must meet its legal obligations and if the Governor wishes to reach 60 percent of the workforce with a higher education by 2030, the investments needed start with the work of the legislature in 2017.

Dave Wells holds a doctorate in Political Economy and Public Policy and is the Research Director for the Grand Canyon Institute, a centrist fiscal policy think tank founded in 2011. He can be reached at DWells@azgci.org or contact the Grand Canyon Institute at (602) 595-1025.

The Grand Canyon Institute, a 501(c) 3 nonprofit organization, is a centrist think tank led by a bipartisan group of former state lawmakers, economists, community leaders and academicians. The Grand Canyon Institute serves as an independent voice reflecting a pragmatic approach to addressing economic, fiscal, budgetary and taxation issues confronting Arizona.