Budget

Budget

Gov. Brewer’s Sales Tax Reforms Hurt Growing Communities and Likely Reduce Overall Revenue

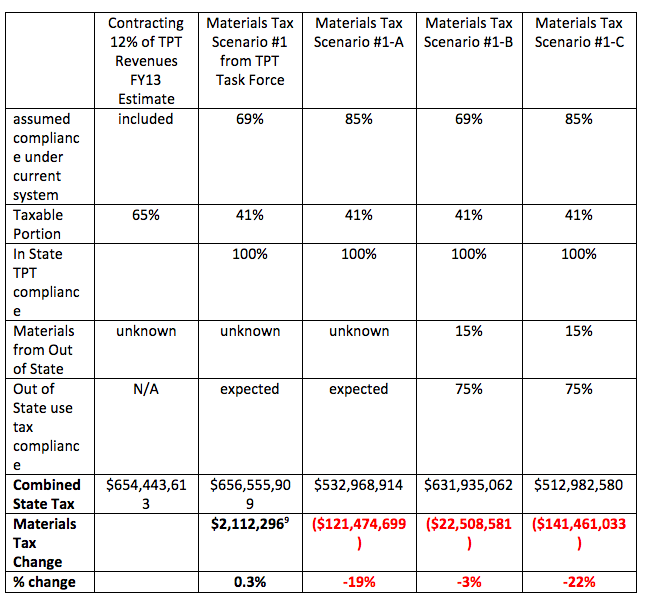

February 14, 2013Governor Jan Brewer at a press conference on Monday introduced HB2657 to reform the state’s sales tax system (technically a Transaction Privilege Tax or TPT) and make it more efficient. The Grand Canyon Institute overall applauds the general mission of the bill, but finds two critical short-comings. The bill undercuts revenues for communities that are growing despite doubling the share that goes to municipalities in the distribution base for contracting, because growing communities will no longer be assured of collecting a similar portion of local taxes on contractors. In addition, the Grand Canyon Institute has concerns about the net revenue impact. The Transaction Privilege Simplification Task Force made a better case scenario assumption regarding revenues. A switch to materials-based point of sale taxes for contracting could reduce total state revenues (including shared revenues) from contracting by either a small amount or upwards of 20 percent (or $140 million annually). Due to shared revenue formula changes, the General Fund impacts would be even greater. Better data is needed, so the fiscal impact is better known.

Legislative Analysis

February 14, 2013

Gov. Brewer’s Sales Tax Reforms Hurt Growing Communities and Likely Reduce Overall Revenue

Governor Jan Brewer at a press conference on Monday introduced HB2657 to reform the state’s sales tax system (technically a Transaction Privilege Tax or TPT) and make it more efficient. The Grand Canyon Institute overall applauds the general mission of the bill, but finds two critical short-comings. The bill undercuts revenues for communities that are growing despite doubling the share that goes to municipalities in the distribution base for contracting, because growing communities will no longer be assured of collecting a similar portion of local taxes on contractors. In addition, the Grand Canyon Institute has concerns about the net revenue impact. The Transaction Privilege Simplification Task Force made a better case scenario assumption regarding revenues. A switch to materials-based point of sale taxes for contracting could reduce total state revenues (including shared revenues) from contracting by either a small amount or upwards of 20 percent (or $140 million annually). Due to shared revenue formula changes, the General Fund impacts would be even greater. Better data is needed, so the fiscal impact is better known.

The Good: Efficient Taxes, Steps to Unifying the Tax Base

One of the proposals is to create a more standard tax base for the TPT across the state and find means to simplify the collection process from businesses. From an efficiency standpoint, simplifying collections and standardizing the tax base across the state are good ideas and helpful to businesses working across multiple jurisdictions. For a given business, it’s far easier to change a tax rate to be applied in Tucson to Tempe, than to have to change items on which the tax is applied.

The Governor’s Transaction Privilege Tax Simplification Task Force chose to keep some areas for possible local, but not state taxation, such as food for home consumption, so this legislation should be seen as step toward a unified tax base.

Problematic: HB2657 Does Not Match Revenue Growth to Demand for Local Public Government Services

Revenue growth needs to match the growth in demand for government services in order for a tax system to work well. This leads to one of the primary concerns related to the change in which contracting/construction are dealt with by HB2657.

HB2657 would change the way contractors pay taxes on materials from the current system where taxes are due at the point where services are rendered to the point of purchase, which may be out of state.

When new residents move into a community, the demand for government services like schools, water, roads, waste management, parks and other infrastructure grows. So from a taxation standpoint, new construction brings with it a demand for government services that must be funded. The current system matches this up well, as communities that are growing faster accrue more revenue due to the local portion of these taxes.

HB2657 violates that goal. Localities may still assess local sales taxes on materials purchased, but we have no idea how well that correlates to where the construction is taking place. The link between where materials are purchased and where the construction takes place will be much lower than the current situation where all local taxes are placed where the construction takes place.

The shared revenues, even though enhanced in HB2657, may keep cities and towns in a similar fiscal position in the aggregate, but the distribution won’t reflect where the greatest demand for government services lies.

Imagine three cities: A, B, and C. Each city has a population of 100,000 in the 2010 census. City A grows by 20,000, City B grows by 10,000 and City C does not grow at all.

The shared revenue which would increase under HB2657 is done in proportion to the city’s population in the 2010 census, so each is receiving an identical share of revenue. HB2657 doubles the part from contracting that goes into the distributional base for revenue sharing from the state from 20 percent to 40 percent (which is the normal rate for retail). With this change and other statuary adjustments, the TPT Taskforce concludes that total local revenues will rise by about six percent with the formula change.

However, in the hypothetical above each city would receive that six percent equally, when, in fact, City A has grown by 20 percent and City C has not grown at all. So City C ends up with a disproportionate benefit and City A receives a disproportionate loss of funding under HB2657.

So combined with additional loss of local sales tax revenues that City A would incur from a point of sale tax, City A would be in a much worse revenue position under HB2657 than they are presently.

Problematic: Total State Tax from Contracting Could Drop Significantly

Presently, the TPT is collected by local governments in a process that is tied to the licensing and building permits required and overseen by local governments. It is for this reason that the Arizona League of Cities and Towns questions the Arizona Department of Revenue’s estimate that 31 percent of construction activity is currently evading the TPT. While there are many contractors, it’s a fairly concentrated business that is primarily centered in major population centers. The TPT Task Force has many public documents, but does not include among them how the Arizona Department of Revenue evaluated the estimates of noncompliance. The TPT Final Report says estimates of noncompliance range from 20 to 40 percent, but none of the details were made public by the Task Force. The League of Cities and Towns considers the estimate too high.

The Grand Canyon Institute would like the estimates of compliance released publicly for review.

If the state moved to a point of sale basis, then all in state sales would likely be collected. However, out of state suppliers of materials would be subject to a “use” tax, which requires that the purchaser voluntarily document and pay this amount. For general consumers this is a tax that is widely evaded in on line purchases, though the state is gradually reining it in via greater compliance through on line vendors. However, removing localities from the audit process as HB2657 does would place the state, which is not connected to the local permitting and inspection process, in charge of an area that they would not be well equipped to oversee. As such, evasion of the “use” tax will likely occur. However, there is no clear inclusion of such evasion in the TPT Task Force’s estimates.

The Department of Revenue presentation to the Contracting Working Group of the TPT Taskforce on October 16, 2012 indicated that they had no data on out of state purchases. Currently as point of sale taxes do not apply to contractors, no data is collected. Hence, noncompliance with a use tax on out of state purchases are not known.

For estimates of the materials-based tax, GCI uses the Task Force’s Scenario #1. Scenario #2 of the Task Force appears to include the added improvement in out of state retail taxation from on line purchases which is independent of the contracting issue. Scenario #1 contrasted revenue from a Materials Point of Sale Tax to the current system whereby contractors pay TPT based on 65 percent of the total value of the contract. Scenario #1 assumes that material costs are 41 percent of contracting costs, an assumption that appears to be well grounded.

Contracting is a highly cyclical portion of TPT receipts for the state of Arizona. At the height of the real estate boom in 2007, contracting was 22 percent of receipts, by 2011 that had fallen to 10 percent. In 2012 it was 11 percent. In the Grand Canyon Institute analysis, GCI assumes for FY2013 it is 12 percent using the current tax system.

The Grand Canyon Institute focuses only on the total revenue generated including shared revenues based on the state-assessed portion of the tax on contracting in our estimates below.

GCI added two addition variables: changes in the current compliance rate as well as a portion for out-of-state sales that did not comply with the use tax in deriving estimates.

While the Task Force showed a neutral impact on revenue—though a loss of $64 million to the General Fund—when changes are made to assumptions, revenue drops anywhere from 3 to 22 percent (see Table 1).

Table 1 Comparison of Current Contracting Policy with Change to Materials Tax

GCI examined scenarios where the current noncompliance rate is half of what the task force assumed and where up to 15 percent of materials are purchased from out of state, but there is a 25 percent noncompliance rate for out of state purchases.

GCI is not suggesting that any of our estimates are correct, as the data is insufficient, but it does appear that the Task Force estimates were based on closer to a best case scenario. Policymakers would be wise to obtain more transparent estimates based on better data before making such a large change to policy.

Prepared by Dave Wells, Ph.D.

Dave Wells holds a doctorate in Political Economy and Public Policy and is the Research Director for the Grand Canyon Institute.

Reach the author at DWells@azgci.org or contact the Grand Canyon Institute at (602) 595-1025

The Grand Canyon Institute, a 501(c)3 nonprofit organization, is a centrist think-thank led by a bipartisan group of former state lawmakers, economists, community leaders, and academicians. The Grand Canyon Institute serves as an independent voice reflecting a pragmatic approach to addressing economic, fiscal, budgetary and taxation issues confronting Arizona.

Grand Canyon Institute

P.O. Box 1008

Phoenix, AZ 85001-1008

GrandCanyonInstitute.org