Budget

Budget

Prop. 206: $12 Minimum Wage has Negligible Fiscal Impact on State Budget

February 13, 2017Policy Paper

February 13, 2017

Policy Paper

February 13, 2017

Prop. 206: $12 Minimum Wage has Negligible Fiscal Impact on State Budget

Dave Wells, Research Director

Executive Summary

Arizona’s minimum wage prior to January 1, 2017 was $8.05 an hour. In November Arizona voters approved Prop. 206 which raises the minimum wage to $12 in steps by 2020 starting with an initial increase to $10 an hour on January 1, 2017. What is its fiscal impact on Arizona?

The discussion on the fiscal impact of Prop. 206 to date has focused solely on the added costs to the state government due to contracts with healthcare providers for elderly, physically and developmentally disabled individuals who employ caregivers whose wages will rise as a consequence of Prop. 206. The numbers put forward are quite modest despite some of the rhetoric employed such as Glenn Hamer of the Arizona Chamber of Commerce claiming the fiscal impact was “poised to blow a giant hole in the state budget.” Yet purported costs amount to about 25 cents out of $100 relative to the General Fund. In addition, fiscal issues with healthcare providers pre-date Prop. 206. The state cut provider rates starting in 2009, and failed to adjust them, such that today those rates are still lower than they were in 2009. Consequently, Prop. 206 has forced the state to deal with a fiscal issue that the state had neglected for years.

The added costs entail two aspects—one as a consequence of Prop. 206 (directly affected workers) and the other due to employers voluntarily raising they pay of other workers (indirect effect). These cost amounts to approximately $22.7 million for FY2018 to the State General Fund. Three-quarters goes to directly affected workers who were paid less than $10 an hour previously, and the rest to indirectly affected workers whose wages already exceeded $10 an hour.

The public discussion has omitted two other prime impacts of Prop. 206. One, Prop. 206 is estimated to increase the annual earnings of impacted low income households by an average of

| The impact of Prop. 206 on the General Fund is approximately one dime (10 cents) for every $100 allocated. |

$1,400 per year by 2020. Consequently, the state will experience a reduced impact on the General Fund to the degree that enrollees in AHCCCS (Medicaid) either move above its top income threshold, 138% of the Federal Poverty Line, or parents enrolled in AHCCCS move from the higher state cost category below 100% of the Federal Poverty Line (FPL) to the higher federally funded Affordable Care Act (ACA) expansion population (100-138% of FPL). This report estimates approximately 30,000 adults and children will be impacted resulting in a savings to the state of $17 million by 2020. For FY2018 the state savings should be closer to $7 million.

Secondly, higher minimum wages lead to a number of additional effects. Primarily it redistributes income from higher income households to lower income households through the slight price increases that pay for it. In addition, some job losses are expected (about 15,000 by 2020), and firms will typically aim to improve the productivity of their existing labor pool—which may include more intensive work (shorter staffing) or re-organizing to improve the productivity of existing workers. Worker motivation may rise and turnover may decline. The added costs may also lead some businesses to have lower profits, but also the shift in incomes to lower income workers will lead to a very modest gain in overall economic activity leading to regaining about 2,000 jobs and increasing economic growth by $275 million, which should bring in an additional $4.7 million in state general fund revenues of which $2 million would be received in FY2018. Both of those revenue estimates may be excessively conservative as research from Chicago Federal Reserve economists suggests higher economic growth such that revenues would be $10 million more in FY2018 and at least $20 million in FY2021.

The effects are summarized below. Effectively, the impact of Prop. 206 on the General Fund is approximately one dime (10 cents) for every $100 allocated, a negligible impact.

Summary of Fiscal Impacts of Prop. 206

| Category | FY2018 | FY2021 |

| Additional Expenses | ||

| Added Healthcare Reimbursement Costs | $22.7 M | $36.4 M |

| Portion due to statutory requirement | $16.7 M | $26.7M |

| Additional Revenue and Savings | ||

| Savings from Medicaid Offset | ($ 7 M) | ($17 M) |

| Additional Revenue | ||

| IMPLAN EstimateChicago Fed Estimate | ($ 2 M)($ 10.1 M) | ($ 4.7 M)($20.3 M) |

| Net General Fund Impact | $5.6 M – $13.7M | ($0.9 M) – $14.7 M |

| % of General Fund | 0.06% – 0.14% | (0.01%) – 0.14% |

Policy Paper

February 13, 2017

Prop. 206: $12 Minimum Wage has Negligible Fiscal Impact on State Budget

Dave Wells, Research Director

Executive Summary

Arizona’s minimum wage prior to January 1, 2017 was $8.05 an hour. In November Arizona voters approved Prop. 206 which raises the minimum wage to $12 in steps by 2020 starting with an initial increase to $10 an hour on January 1, 2017. What is its fiscal impact on Arizona?

The discussion on the fiscal impact of Prop. 206 to date has focused solely on the added costs to the state government due to contracts with healthcare providers for elderly, physically and developmentally disabled individuals who employ caregivers whose wages will rise as a consequence of Prop. 206. The numbers put forward are quite modest despite some of the rhetoric employed such as Glenn Hamer of the Arizona Chamber of Commerce claiming the fiscal impact was “poised to blow a giant hole in the state budget.” Yet purported costs amount to about 25 cents out of $100 relative to the General Fund. In addition, fiscal issues with healthcare providers pre-date Prop. 206. The state cut provider rates starting in 2009, and failed to adjust them, such that today those rates are still lower than they were in 2009. Consequently, Prop. 206 has forced the state to deal with a fiscal issue that the state had neglected for years.

The added costs entail two aspects—one as a consequence of Prop. 206 (directly affected workers) and the other due to employers voluntarily raising they pay of other workers (indirect effect). These cost amounts to approximately $22.7 million for FY2018 to the State General Fund. Three-quarters goes to directly affected workers who were paid less than $10 an hour previously, and the rest to indirectly affected workers whose wages already exceeded $10 an hour.

The public discussion has omitted two other prime impacts of Prop. 206. One, Prop. 206 is estimated to increase the annual earnings of impacted low income households by an average of

| The impact of Prop. 206 on the General Fund is approximately one dime (10 cents) for every $100 allocated. |

$1,400 per year by 2020. Consequently, the state will experience a reduced impact on the General Fund to the degree that enrollees in AHCCCS (Medicaid) either move above its top income threshold, 138% of the Federal Poverty Line, or parents enrolled in AHCCCS move from the higher state cost category below 100% of the Federal Poverty Line (FPL) to the higher federally funded Affordable Care Act (ACA) expansion population (100-138% of FPL). This report estimates approximately 30,000 adults and children will be impacted resulting in a savings to the state of $17 million by 2020. For FY2018 the state savings should be closer to $7 million.

Secondly, higher minimum wages lead to a number of additional effects. Primarily it redistributes income from higher income households to lower income households through the slight price increases that pay for it. In addition, some job losses are expected (about 15,000 by 2020), and firms will typically aim to improve the productivity of their existing labor pool—which may include more intensive work (shorter staffing) or re-organizing to improve the productivity of existing workers. Worker motivation may rise and turnover may decline. The added costs may also lead some businesses to have lower profits, but also the shift in incomes to lower income workers will lead to a very modest gain in overall economic activity leading to regaining about 2,000 jobs and increasing economic growth by $275 million, which should bring in an additional $4.7 million in state general fund revenues of which $2 million would be received in FY2018. Both of those revenue estimates may be excessively conservative as research from Chicago Federal Reserve economists suggests higher economic growth such that revenues would be $10 million more in FY2018 and at least $20 million in FY2021.

The effects are summarized below. Effectively, the impact of Prop. 206 on the General Fund is approximately one dime (10 cents) for every $100 allocated, a negligible impact.

Summary of Fiscal Impacts of Prop. 206

| Category | FY2018 | FY2021 |

| Additional Expenses | ||

| Added Healthcare Reimbursement Costs | $22.7 M | $36.4 M |

| Portion due to statutory requirement | $16.7 M | $26.7M |

| Additional Revenue and Savings | ||

| Savings from Medicaid Offset | ($ 7 M) | ($17 M) |

| Additional Revenue | ||

| IMPLAN EstimateChicago Fed Estimate | ($ 2 M)($ 10.1 M) | ($ 4.7 M)($20.3 M) |

| Net General Fund Impact | $5.6 M – $13.7M | ($0.9 M) – $14.7 M |

| % of General Fund | 0.06% – 0.14% | (0.01%) – 0.14% |

Overview

Proposition 206 was passed by voters in November and increased the state’s minimum wage from $8.05 per hour ($5.05 for tipped workers) to $12 an hour ($9 an hour for tipped workers) with the following steps, the first of which has already gone into effect:

- January 1, 2017: $10 an hour ($7 an hour for tipped workers)

- January 1, 2018: $10.50 an hour ($7.50 an hour for tipped workers)

- January 1, 2019: $11 an hour ($8 an hour for tipped workers)

- January 1, 2020: $12 an hour ($9 an hour for tipped workers)

In addition, it would require that employees accrue a minimum of 1 hour of paid sick time for every 30 hours worked up to a maximum of 24 hours for a calendar year for smaller employers and 40 hours per calendar year for larger employers.

This analysis evaluates the potential impact of the higher minimum wage. The paid sick time should enhance the ability of lower wage workers to handle personal and family emergencies and medical issues without loss of employment and should have a fairly negligible impact on employers.

This analysis will cover the following areas:

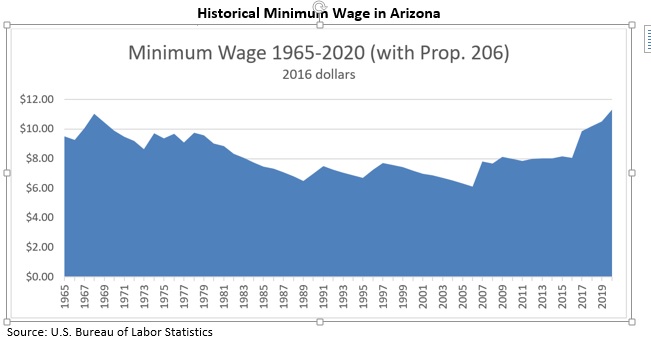

- Historical changes in the minimum wage and how $10 and $12 an hour compare to past minimum wages in today’s dollars.

- Portion of Arizona workers impacted by the higher minimum wage

- Estimated gains and losses in the labor market as a consequence of Prop. 206

- Estimated Cost Impact on General Fund to healthcare contractors

- Estimated Impact on General Fund from changes in Medicaid eligibility due to higher incomes

- Estimated impact on the economy and government revenues

Prop. 206 increases the minimum wage to a level that was last seen in the late 1960s when controlling for inflation, so the change is within historical experience, though for only a short period of time. Using data from federal employer surveys, this evaluation finds that approximately 803,000 Arizona workers would be directly or indirectly impacted by an increase of the minimum wage, 30 percent of those employed.

| Following the spirit of the Congressional Budget Office’s approach, the Grand Canyon Institute estimates a $12 minimum wage in 2020 will lead to approximately 13,000 fewer jobs with 790,000 workers receiving positive hourly wage gains. |

This study uses the middle estimate from the Grand Canyon Institute’s October 2016 report following the spirit of the Congressional Budget Office’s (CBO) approach when they evaluated a $10.10 minimum wage in 2014. Adjusting the CBO approach for a more significant increase in the minimum wage to $12 an hour, the Grand Canyon Institute estimates employment losses of approximately 13,000, with 790,000 workers receiving positive hourly wage gains. Job losses to the degree they occur may manifest themselves as lower employment growth, for perspective, the state of Arizona currently adds approximately 15,000 jobs at all pay levels per quarter.

Historical Change in the Minimum Wage 1965-2020

| Adjusted for inflation, the minimum wage in 2020 would slightly exceed the buying value of the 1968 minimum wage. |

The Fair Labor Standards Act in 1938 established the first federal minimum wage at 25 cents an hour. The FLSA required Congressional authorization for the minimum wage to be increased, which has occurred 22 times under 12 Presidents, most recently President Obama in 2009.[1] Until 2006 Arizona followed the federal minimum wage. However, due to a ballot initiative passed in 2006, the Arizona minimum wage increased from the then federal level of $5.15 an hour to $6.75 an hour in 2007, and has been adjusted annually for changes in the consumer price index. The federal minimum also went up in 2007, 2008 and 2009, ultimately to $7.25 an hour.

Figure 1 looks back historically at the buying power of the minimum wage from 1965 until today as well as projecting the real value of the minimum wage through 2020. The real minimum wage is shown in 2016 dollars, so one can see how much past minimum wages are worth today. In addition, assuming an inflation level of 1.5 percent per year, the buying power of future minimum wage levels are indicated. Because 2020’s minimum wage of $12 an hour is expressed in 2016 dollars, not 2020 dollars, you’ll note that in 2016 dollars the value of the minimum wage is $11.31 an hour. Likewise, the $10 an hour minimum wage appears as $9.85 to reflect the 1.5 percent anticipated inflation from 2016 to 2017.

Figure 1 illustrates that from 1967-1970, the federal minimum wage of $1.60 in today’s dollars would exceed the buying power of a $10 minimum in 2017. The $11.31 value of the minimum wage in 2020 would slightly exceed the $11.03 buying value of the 1968 minimum wage. Consequently, Prop. 206 returns the minimum wage to a level on par with the late 1960s.

Figure 1

Portion of Arizona workers impacted by Prop. 206

The Bureau of Labor Statistics reported based on employer surveys that as of May 2015 in Arizona, the 10th percentile of the labor force earned $8.96 an hour, the 25th percentile earned $11.10 an hour, and the median worker earned $16.67 an hour.[2]

These figures provide the basis for estimating how Prop. 206 will impact the workforce. First, one needs to compare the Prop. 206 minimum wage with wage levels that would occur otherwise. With a growing economy with modest unemployment, wages are going up so we presume that by January 2017, wage levels will increase by 3 percent across the board from May 2015 levels. Likewise, each year moving forward, we assume that wage levels would continue to increase by 2 percent in the absence of Prop. 206. For simplicity, the size of the overall workforce is kept constant—so there are no changes either to the distribution of occupations. Though some economic research suggests that higher minimum wages tend to improve the labor force participation rate, which, all other things equal, would modestly increase the unemployment rate.[3]

Table 1 shows the May 2015 wage levels and anticipated wage levels from 2017 to 2020 in the absence of Prop. 206.

Table 1

Current and Projected Distribution of Earnings without Prop. 206

| 10th Percentile | 25th Percentile | Median | 75th Percentile | 90th Percentile | |

| May 2015 | $8.96 | $11.10 | $16.67 | $26.48 | $40.64 |

| January 2017 | 9.23 | 11.43 | 17.17 | 27.27 | 41.86 |

| January 2018 | 9.41 | 11.66 | 17.52 | 27.82 | 42.70 |

| January 2019 | 9.60 | 11.90 | 17.87 | 28.38 | 43.56 |

| January 2020 | 9.80 | 12.13 | 18.22 | 28.95 | 44.43 |

| By 2020 about 800,000 workers are directly or indirectly impacted by a $12 minimum wage, about 30 percent of those employed. |

Source: Bureau of Labor Statistics “Occupational Employment Statistics” for Arizona and annual adjustments computed by author.

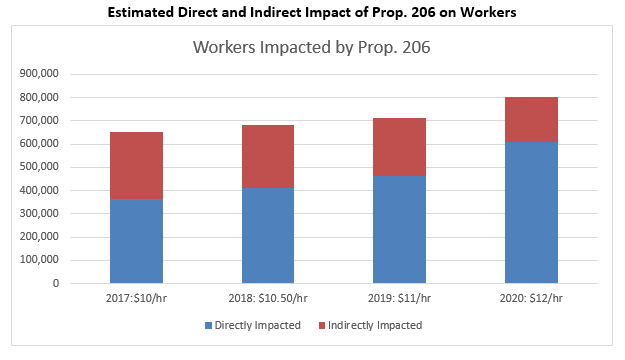

As can be seen in the highlighted areas of Table 1, Prop. 206 imposed minimum wages beyond what those at the 10th percentile are currently earning, and by 2020 would nearly reach the level of the 25th percentile. These are workers directly impacted by Prop. 206 and they are also illustrated in Figure 2, rising from an estimated 360,000 in 2017 to 610,000 in 2020.

However, workers close to the new minimum wage would also be impacted. Economists typically expect additional wage boosts for those workers up to 15 percent above the minimum wage, so workers earning more than $10 an hour up to $11.50 in 2017, and workers earning more than $12 an hour up to $13.80 in 2020. These total about 280,000 workers in 2017 and 190,000 in 2020.[4] These workers should also expect a modest pay increase, as employers try to preserve some level of a premium above the minimum wage to encourage better morale, productivity and lower turnover. So collectively in 2017 about 650,000 workers are directly or indirectly impacted and in 2020 that number rises to about 800,000 out of 2.6 million employed or about 30 percent of those employed.

Figure 2

Population and those employed may continue to grow during this time period, making these numbers somewhat higher than in the chart. For instance, Arizona is currently adding approximately 60,000 jobs per year.[5] If that pace were to continue, the figures estimated here for the number of workers directly and indirectly impacted would be approximately 50,000 higher in 2020. So as not to add additional variables and due to the unknown nature of economic growth in the next three years, the workforce is held constant in this analysis.

Will Prop. 206 reduce employment?

Within the economic literature there is dissension over the impact of higher minimum wages on employment with one segment of the research finding a ten percent rise in the minimum wage corresponding with approximately a 1.5 percent decline in teen employment. That body of research provides less depth with respect to overall impacts of employment but generally considers the impact to be less, as somewhat older workers tend to be more productive.[6]

Over the last 20 years another body of research has utilized establishment level data (e.g., restaurant payroll), especially in the restaurant sector, but recently a seminal paper has sought to expand that methodology to a nationwide database. They find no employment loss due to higher minimum wages.[7] The middle scenario of the Congressional Budget Office is used for the estimates here.

Congressional Budget Office Approach (790,000 workers gain, 13,000 jobs lost)

In 2014 when President Obama proposed a $10.10 federal minimum wage, the nonpartisan Congressional Budget Office (CBO) estimated its impact after doing a thorough review of the literature. A movement from $7.25 to $10.10 an hour represented a 39 percent increase in the minimum wage, less in those states like Arizona that had higher minimum wages.[8]

The age demographic data in Table 2 comes from the Bureau of Labor Statistics for the United States, not just Arizona.[9] Presuming the distribution by age group is approximately the same in Arizona then, applying the approach of CBO leads to an estimated loss of 13,000 Arizona jobs under Prop. 206 compared to a situation where it did not pass. However, 790,000 directly and indirectly impacted workers gain a higher hourly income.

The CBO presumed for teen employment that each 10 percent increase in the minimum wage would reduce teen employment by 1 percent and reduce all other low wage worker employment by 0.33 percent among those impacted directly from the change. Due to Prop. 206’s higher minimum wage, for this analysis, we break workers into two groups. One that currently earns less than $10 an hour and another than earns $10 an hour but less than $12 an hour. We also introduce an additional middle age range of 20-24, so there are three age ranges.

The CBO had inferred that greater increases in the minimum wage would make for a higher elasticity (rate of job loss for a given increase in the minimum wage) more likely. This would largely be due to the greater size of raises that those on the lowest end would be receiving and the larger number of workers impacted. Ultimately in real dollars those earning the $8.05 minimum wage will be receiving a 40 percent pay increase when the minimum wage becomes $12 and hour in 2020. Presumably some employers will reduce their workforce as a consequence and these lower wage workers are far more likely to be laid off than someone who is already earning $10 an hour. As by contrast that $10 an hour worker in real terms will be seeing a 15 percent pay increase as the minimum wage rises to $12 an hour in 2020.

So for those whose wages go up the most, the elasticity of employment (or lost jobs) relative to the minimum wage rising we apply as -0.15 (a 10% rise in the minimum wage leads to a 1.5% fall in employment) for the lower wage group for teens, -0.1 for those 20-24, and -0.6 for those 25 and older. In the higher wage group, we apply similar elasticities as the CBO did in their $10.10 study: -0.1 for teens, -0.6 for those 20-24 and -0.3 for those 25 and older. The presumption is that older workers are more reliable with less turnover, so are consequently more likely to be retained. These results are summarized in Table 2. The 190,000 indirectly effected workers are presumed to also receive some kind of raise with no loss of employment, which is the approach used by the CBO in their analysis. Estimates are to the nearest worker.

Table 2

Wage Gains and Job Losses from $12 Min. Wage (Congressional Budget Office Approach)

| % increase in minimum wage: 40% | % increase in minimum wage: 15% | Indirectly affected | ||||||||

| <$10/hr. | $10 – $11.99/hr. | $12-$13.80/hr. | ||||||||

| Age | % of workers | Elasticity (CBO) | Lost Jobs (CBO) | Workers Gaining | % of workers | Elasticity (CBO) | Lost Jobs (CBO) | Workers Gaining | % of workers | Indirectly gaining |

| 16 to 19 | 17% | -0.15 | -3,679 | 56,963 | 5% | -0.1 | -185 | 12,338 | 2% | 3,780 |

| 20 to 24 | 26% | -0.10 | -3,854 | 91,425 | 21% | -0.06 | -467 | 52,313 | 14% | 26,506 |

| 25 and older | 57% | -0.05 | -4,177 | 202,350 | 74% | -0.03 | -807 | 181,472 | 84% | 162,967 |

| Total | 100% | -11,710 | 350,738 | 100% | -1,459 | 246,123 | 100% | 193,254 | ||

| Total Losses | -13,170 | Total Gains | 790,116 | |||||||

A “Giant hole” that’s Pretty Small: Impact of Prop. 206 on the General Fund

The lawsuit against Prop. 206 has included hyperbolic rhetoric, including Arizona Chamber of Commerce President and CEO Glenn Hamer arguing Prop. 206 “is poised to blow a giant hole in the state budget.”[10] If your definition of giant is 25 cents for every $100 spent, then that’s accurate.

In addition, fiscal issues with healthcare providers pre-date Prop. 206. The Amicus Curiae in the lawsuit from the Arizona Association of Providers for Persons with Developmental Disabilities indicated that through FY2008, the state did a good job of meeting the benchmark for appropriate reimbursement, but in FY2017, the reimbursement rates were actually lower than they were in 2009 due to rate reductions from 2009 and 2011 and a failure to increase them since then. Consequently, Prop. 206 has forced the state to deal with an untenable fiscal situation that the state had neglected for years.[11]

The first phase of the Proposition 206 minimum wage increase to $10.00 per hour took place on January 1, 2017. The initiative also requires most employers to provide paid sick leave for their employees beginning July 1, 2017. While state employees are exempt, many contracted service providers are not. The Joint Legislative Budget Committee (JLBC) estimates the state general fund costs for the remainder of fiscal year (FY) 2017 as $11 million ($3.4 million for the Arizona Health Care Cost Containment System (AHCCCS) and $7.7 million for the Department of Economic Security). The full year costs for FY2018 are approximately double this amount according to the fiscal memo, $22.4 million with $7 million for AHCCCS and $15.4 million for DES. These costs were attributed to contracts for long-term care services for the developmentally disabled, elderly and physically disabled.

Are these costs reasonable estimates? Relying on the wages of Home Health Care Aides as a proxy, Table 3 estimates the impact of Prop. 206 on Home Health Care Aides wages and the impact on total costs. The top 25 percent of the wage distribution for Home Health Care Aides has been eliminated because reimbursement rates are currently below benchmarks. Data is for Arizona from the Department of Labor. The analysis assumes a 3% increase from May 2015 to December 2016 due to market forces.

Table 3

| Home Health Care Aides | Percentile of Distribution | |||||||

| Min. | 10th | 25th | 50th | 75th | Est. Avg. Wage | % increase | Increase Total Cost | |

| May-15 | 8.05 | 8.49 | 9.14 | 10.70 | 12.74 | 9.92 | ||

| Dec-16 | 8.05 | 8.74 | 9.41 | 11.02 | 13.12 | 10.22 | ||

| $10 min. | 10.00 | 10.00 | 10.00 | 11.02 | 13.12 | 10.79 | 5.6% | 2.8% |

| $10 min. + indirect effect | 10.00 | 10.00 | 10.00 | 11.80 | 13.12 | 11.00 | 7.7% | 3.8% |

| $10.50 min + indirect effect | 10.50 | 10.50 | 10.50 | 12.05 | 13.38 | 11.39 | 11.5% | 5.8% |

| $12 min + indirect effect | 12.00 | 12.00 | 12.00 | 12.75 | 14.00 | 12.51 | 15.4%[12] | 7.7% |

Source: For initial wage distributions (not avg. wage). May 2015 hourly wage distribution from U.S. Dept. of Labor for Arizona.

Table 3 indicates that an increase in the minimum wage from $8.05 to $10 an hour leads to an estimated 5.6% increase in wages purely due to the statute. Employers who contract with the state are also likely to voluntarily increase wages for workers who earn above $10 an hour due to the restructuring of the labor market and that increase would diminish the farther workers were above $10 an hour. Including those estimated increases, the increase in wage costs is estimated as 7.7%.

However, service provision while labor intensive has other costs besides those of Home Health Care Aides. They have administrative costs, supervisory costs, rental costs, vehicle costs, and equipment costs. In another labor intensive field, our K-12 District Schools, for instance, instructional costs are about half of total costs. Assuming home health care Aides (or the equivalent kind of worker) was 50% of total costs, the impact on total costs is half the wage increase. So for impacted service providers, total costs rise 2.8% due to Prop. 206. They then take on an additional voluntary cost above Prop. 206 of an additional 1%.

Looking at the JLBC FY2017 Appropriations report under AHCCCS for ALTCS (for physical disabilities and the elderly), the General Fund provided $168 million (p. 41). Based on Table 1 estimates a 1.4% cost increase for half a year, the FY2017 impact on the General Fund would be $2.4 million. Including the voluntary added pay by employers would increase this to $3.2 million. By contrast, the JLBC fiscal memo for AHCCCS places the cost at $3.4 million, which is nearly exactly in line with the Table 4 estimate which includes the voluntary added pay for indirectly effected workers.

For FY2018, the increase would be the average of the $10 and $10.50 minimum wage costs since the fiscal year runs July through June. Labor costs would rise approximately 9.6% and total costs would rise 4.8%. Consequently, the cost to the General Fund would rise an estimated $8 million, which is a bit higher than the $7 million noted in the JLBC memo.

Looking at the JLBC FY2017 Appropriations report under DES for those with developmental disabilities under “Home and Community Based Services-Medicaid,” the General Fund allocated $306 million (p. 149). Based on the Table 1 estimates at a 1.4% cost increase for half a year, the FY2017 impact on the General Fund would be $4.3 million due purely to the statutory requirements of Prop. 206. Including the voluntary added pay by employers would increase this to $5.9 million. By contrast, JLBC relying on the Executive’s estimates cited $7.7 million.

Table 4

| Added Cost Estimates Due to Prop. 206 for FY 2017 | |||

| JLBC Fiscal Memo | Table 3$10 min + indirect wage increases | Table 3$10 min. wage only | |

| AHCCCS | $3.4 M | $3.2 M | $2.4 M |

| DES | $7.7 M | $5.9 M | $4.3 M |

| TOTAL | $11.1 M | $9.1 M | $6.7 M |

| Added Cost Estimates Due to Prop. 206 for FY 2018 | |||

| JLBC Fiscal Memo | Table 3Avg. $10 and $10.50 with indirect wage increase | ||

| AHCCCS | $ 7 M | $ 8 M | |

| DES | $15.4 M | $14.7 M | |

| TOTAL | $22.4 M | $22.7 M | |

| Added Cost Estimates Due to Prop. 206 for FY 2021[13] | |||

| Table 3$12 with indirect wage increase(relative to est. wages without Prop. 206) | |||

| AHCCCS | $12.9 M | ||

| DES | $23.5 M | ||

| TOTAL | $36.4 M | ||

For FY2018 the increase would be approximately 9.6% and total costs rise 4.8%. Consequently, the cost to the General Fund would be $14.7 million. That figure is slightly less than the $15.4 million cited in the JLBC memo as summarized in Table 4.

Finally projecting to 2020 when the minimum wage increase is fully implemented, the total estimated cost including the indirect wage increases would be $36.4 million.

| As the General Fund is approaching $10 billion, these costs are relatively trivial, amounting to about 0.25 percent for FY2018. |

The JLBC Fiscal Memo also highlights some other possible costs including in K-12 school districts for cafeteria workers and classroom Aides that could total $10 million in FY2018. These figures would also include voluntary pay increases as well as those that are statutorily required. However, school districts receive funding from local property taxes as well as the state. In addition, most school cafeteria operations are designed to be self-sustaining from revenue from their breakfast and lunch programs including likely participation in the federal school nutrition program which provides funding. Finally, these are not contracts with the state, so this would be a cost to be absorbed in school districts. Relative to their budgets, this is a nominal impact.

Finally, under social service programs, the cost of services is also noted, such as wage increases to child care providers for low-income families. Again these costs would include payments for raises above what is statutorily required by Prop. 206. In addition, the state does not use the General Fund to pay for it. The JLBC 2017 Appropriations Report under DES for Child Care Subsidy shows that $98 million funded it for FY2017 with $95.7 million from the Federal CCDF Block Grant and another $2.7 million from the Federal TANF Block Grant (p 153). So no state General Fund dollars are allocated here. Consequently, this area, too, is not pertinent, at least for the example provided by the JLBC fiscal memo.

So for the balance of FY2017 and for FY2018 the cost to the state would be approximately $10 million and $23 million, respectively, with costs eventually reaching $36 million in 2020. As the General Fund is approaching $10 billion, these costs are relatively trivial, less than 1 percent of the state General Fund, amounting to about 0.25 percent for FY2018.

Savings due to Added Income among Medicaid Recipients

Medicaid financing is fairly complex with various populations and various matches from the federal government. In addition, the state portion is paid from three sources: the General Fund, the hospital assessment imposed when Arizona expanded Medicaid in 2013, and the Tobacco Settlement monies approved as part of Prop. 204 in 2000.

However, any savings in the state share is transmitted to the General Fund. For instance, the primarily revenue source for expanding Medicaid eligibility under Prop. 204 was the Tobacco Settlement (about $100 million annually). To the degree Tobacco Settlement funds or Hospital Assessment funds (about $250 million) are freed up, they can be re-allocated, so savings can be provided to the General Fund.

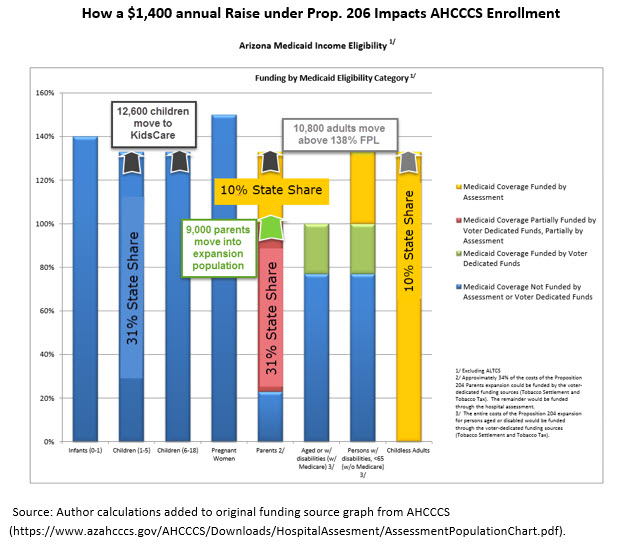

With Prop. 206, the state General Fund saves money to the degree parents move from being part of Section 1931 of the Social Security Act that was amended in 1996 to allow states to expand coverage as Arizona did under Prop. 204 (37-100% of the FPL) to the ACA Expansion Population (100-138% of the FPL). A combination of Tobacco Settlement monies and the Hospital Assessment pays 31% of the costs for those under Section 1931, and the Hospital Assessment picks up the cost not covered by the federal government for the expansion population. However, the state only pays 10% of the cost for the expansion population, a drop of 21% (see Figure 3). Likewise, if families move above 138% of thee FPL, then they no longer would be served by AHCCCS, though the children could transition to KidsCare. In that case for parents, the state share drops from 10% to zero, and the state share for children drops from 31% with AHCCCS to 23% under KidsCare.[14] Savings here would redistribute to the General Fund.

| Due to raises of about $1,400 a year, about 30,000 people on AHCCCS would change categorical status, saving the state $17 million a year. |

David Cooper, a Senior Economic Analyst, with the Economic Policy Institute provided data on Arizona workers impacted by Prop. 206. That impact data that is largely consistent with the estimates the Grand Canyon Institute had done in October 2016. The Grand Canyon Institute data was occupationally based; the Economic Policy Institute (EPI) data comes from the Current Population Survey and provides substantially more demographic breakouts on individuals and households and provides full income effect estimates across each of these groups. The EPI estimates of 609,000 directly affected workers and 175,000 indirectly affected workers are almost identical to the GCI estimates of 610,000 (including 13,000 job losses) directly and 193,000 indirectly affected workers. EPI estimates that the average worker would see an annual income increase of $1,400 by 2020 when Prop. 206 was fully implemented.

Using that data and the demographic and categorical populations provided by AHCCCSS, this study estimates that, by 2020, 9,000 parents will move from Section 1931 of the Social Security Act where the state pays 31% of the cost of enrollees to the expansion population of the Affordable Care Act., where the state’s share is 10%.

In addition, 10,800 adults currently in the expansion population of the ACA would move beyond it, and become eligible for subsidized insurance in the healthcare exchange—or whatever might replace it by 2020, so they would move from where the state pays 10% to no longer being on AHCCCS.

Figure 3

Many of those adults are parents. Their children, an estimated 12,600, would move with their parents. This analysis assumes they move from AHCCCS to KidsCare, and that the KidsCare state match, currently zero, returns to 23%. So the state share drops from 31% under AHCCCS to 23% with KidsCare.

This movement is shown in Figure 3 with the calculations in Table 5.

Table 5

| Parents 67-100% FPL | Adult Expansion | Children to KidsCare | |

| Total Population | 75,000[15] | 90,000[16] | 105,000[17] |

| Portion Impacted by Prop. 206[18] | 60% | 60% | 60% |

| $1,400 raise moves out of category[19] | 20% | 20% | 20% |

| Number moving beyond category | 9,000 | 10,800 | 12,600 |

| Cost Per Member[20] | $5,000 | $5,000 | $2,500 |

| State Share Change[21] | -21% | -10% | -8% |

| State Budget Change | ($9,450,000) | ($5,400,000) | ($2,520,000) |

| Total State Budget Change | ($17,370,000) | ||

Table 5 suggests savings of about $17 million in FY2021—and in FY2018 about $7 million of that should be realized.

Revenue Grains from Prop. 206

Higher Minimum Wages bring four effects:

- Boost in wages for impacted workers both those directly impacted and those indirectly impacted who get raises because their wage is close to the new minimum wage (about 785,000)

- Loss of jobs due to the higher costs (15,000 estimate)

- Higher prices due to the added costs of the minimum wage (about 1 percent across a range of services)

- Economic Growth and Employment Gains due to the higher incomes of lower wage workers (despite job losses and higher prices—about $275 million in growth and 2,000 added jobs, respectively).

Using the IMPLAN Input-Output Economic Model for Arizona combined with wage gain estimates of the Economic Policy Institute, a total impact on the economy was estimated, including an impact on state revenue.

The Economic Policy Institute data assumed no negative impacts from the higher minimum wage in which case the immediate impact would be a positive $1.2 billion.

Based on the job loss estimates provided earlier, this analysis presumed that 2.5 percent of directly affected jobs were lost. In addition, $69 billion in household expenditures for products and services where the higher minimum wage could impact prices were identified. The estimated average price increase was 1 percent for these sectors. Research on full service restaurants indicates that a $12 min. wage should increase their prices by about 1.6% (where labor is 31% of total costs). Fast food costs would rise more (about 6%).[22] Most of the sectors identified, though, would be less reliant on lower wage labor. It would be higher in some cases and lower in others. Consider a typical firm where lower wage workers were 10 percent of total costs and their wages on average went up 10 percent (e.g., from $10.90 to $12 an hour), then that would generate a 1 percent increase in costs.[23] See Appendix for a full list of products and services likely impacted and the spending in each area.

Beyond job losses and price increases, employers will seek to improve their use of labor to be more productive. In addition, research also finds that duration of employment increases, i.e., turnover decreases, in response to the higher minimum wage.[24] This also improves productivity, as employers retain a more productive workforce and spend less time searching for replacement workers. These aspects along with the greater velocity of spending for lower wage workers compared to those with higher incomes and their greater likelihood of spending locally leads to the basis for economic growth.

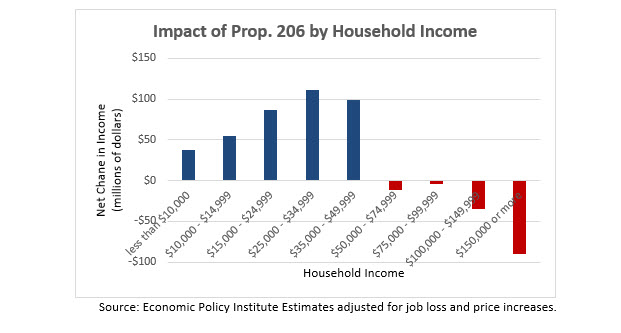

Figure 4

The job loss and price adjustments reduced the $1.2 billion gain to a much more modest $250 million, which included net gains of about $390 million for households under $50,000 a year—and a net loss of roughly $140 million for households with incomes above $50,000 a year. The distribution of that $250 million is shown in Figure 4, which illustrates how a higher minimum wage redistributes income from higher income households to lower and middle income households.

This $250 million then is re-spent and re-circulated in the economy yielding a modest gain in economic activity of $275 million which generates 2,000 additional jobs. Note that these events are interrelated, not sequential. The added demand is happening at the same time prices are adjusting.

In addition, tax revenues would be generated including

- Personal Income Taxes $1 million ($850,000 to State General Fund)

- Sales Taxes $7.2 million ($3.5 million to State General Fund)

- Insurance Premium Taxes $340,000 to State General Fund

In addition, some additional revenue could come to the General Fund from corporate taxes, but as some corporate profits may be negatively impacted by Prop. 206 and the legislature has significantly reduced corporate tax revenue, for this analysis they are excluded.

Hence, total added revenue to the General Fund should bet $4.7 million in 2020. For FY2018 the gains should be about $2 million.

This estimate could be conservative. Two economists at the Chicago Federal Reserve, David Aaronson and Eric French, in a Chicago Fed Letter of August 2013 analyzed the impact of a $1.75 increase in the minimum wage—which essentially corresponds with the increase that occurred in Arizona on January 1, 2017 due to Prop. 206. They find that the higher minimum wage would lead to economic growth of an added 0.3% and when they adjust for job loss the result is 0.2%. The job loss estimates they use are significantly higher than those used in this report, and the authors consider it “at the high end of the literature,” so using 0.2% as a growth estimate would be on the more conservative end and 0.3% would be on the more optimistic end.[25] By contrast the IMPLAN estimate here yielded only 0.09% growth with a $12 min. wage. The authors also adjusted for any decline in consumer demand due to higher prices which could impinge consumer demand.

If Aaronson and French are correct, then the revenue estimates would be considerably higher. Using their more conservative growth estimate of 0.2%, the impact for a $12 min. wage would be double that. Presuming a similar revenue ratio relative to economic growth as with the IMPLAN estimate, the Chicago Fed model would yield about $10 million in revenue in FY2018 and $20 million in FY2021.

Conclusion: Negligible Impact on the General Fund

This study finds that Prop. 206 will result in added costs of $23 million in FY2018 rising to $36 million in 2020—amounting to about 25 cents out of every $100 spent in the General Fund. That amount is largely offset by savings in Medicaid that should equal about $7 million in FY2018 and $17 million in 2020. The most challenging part is determining the broader impact on the economy, but at minimum the state should expect $2 million in FY2018 and about $4.7 million in 2020 in added revenue—though those revenue estimates may be too low. The growth estimates adjusted for job losses used by Chicago Federal Reserve economists Aaronson and French would yield revenues of $10 million and $20 million, respectively.

These results are summarized in Table 6 below. Regardless of how the final math might add up, the net fiscal impact of Prop. 206 on the General Fund is negligible.

Table 6

Summary of Fiscal Impacts of Prop. 206

| Category | FY2018 | FY2021 |

| Additional Expenses | ||

| Added Healthcare Reimbursement Costs | $22.7 M | $36.4 M |

| Portion due to statutory requirement | $16.7 M | $26.7M |

| Additional Revenue and Savings | ||

| Savings from Medicaid Offset | ($ 7 M) | ($17 M) |

| Additional Revenue | ||

| IMPLAN EstimateChicago Fed Estimate | ($ 2 M)($ 10.1 M) | ($ 4.7 M)($20.3 M) |

| Net General Fund Impact | $5.6 M – $13.7 M | ($0.9 M) – $14.7 M |

| % of General Fund | 0.06% – 0.14% | (0.01%) – 0.14% |

Dave Wells holds a doctorate in Political Economy and Public Policy and is the Research Director for the Grand Canyon Institute, a centrist fiscal policy think tank founded in 2011. He can be reached at DWells@azgci.org or contact the Grand Canyon Institute at (602) 595-1025.

The Grand Canyon Institute, a 501(c) 3 nonprofit organization, is a centrist think tank led by a bipartisan group of former state lawmakers, economists, community leaders and academicians. The Grand Canyon Institute serves as an independent voice reflecting a pragmatic approach to addressing economic, fiscal, budgetary and taxation issues confronting Arizona.

Grand Canyon Institute

P.O. Box 1008

Phoenix, Arizona 85001-1008

GrandCanyonInsitute.org

Appendix

Areas with Possible Price Increases

| IMPLAN Model Prop 206 Min Wage Impact. | Copyright 2017 Minnesota IMPLAN Group, Inc. |

| Arizona Household Consumption for Specific Products and Services | Total |

| Agriculture and forestry support services | 12,866,705.27 |

| Wholesale trade distribution services | 6,639,490,676.88 |

| Retail Services – Motor vehicle and parts | 2,891,265,148.16 |

| Retail Services – Furniture and home furnishings | 753,959,131.24 |

| Retail Services – Electronics and appliances | 949,954,906.46 |

| Retail Services – Building material and garden supply | 1,140,031,782.15 |

| Retail Services – Food and beverage | 2,864,757,591.25 |

| Retail Services – Health and personal care | 1,435,936,508.18 |

| Retail Services – Gasoline stations | 972,465,839.39 |

| Retail Services – Clothing and clothing accessories | 1,504,495,595.93 |

| Retail Services – Sporting goods, hobby, book and music | 619,990,017.89 |

| Retail Services – General merchandise | 2,745,071,147.92 |

| Retail Services – Miscellaneous | 1,194,051,637.65 |

| Retail Services – Nonstore, direct and electronic sales | 1,594,721,744.54 |

| Air transportation services | 1,577,706,645.97 |

| Rail transportation services | 71,877,904.06 |

| Water transportation services | 58,621,078.19 |

| Truck transportation services | 887,363,231.66 |

| Transit and ground passenger transportation services | 424,231,924.06 |

| Pipeline transportation services | 32,973,115.09 |

| Scenic and sightseeing transportation services and support activities for transportation | 62,782,996.89 |

| Couriers and messengers services | 30,528,154.79 |

| Warehousing and storage services | 7,252,324.94 |

| Funds, trusts, and other financial services | 1,822,764,636.04 |

| Real estate buying and selling, leasing, managing, and related services | 7,235,262,512.21 |

| Automotive equipment rental and leasing services | 1,043,574,314.12 |

| General and consumer goods rental services except video tapes and discs | 320,688,970.57 |

| Video tape and disc rental services | 86,026,341.32 |

| Accounting, tax preparation, bookkeeping, and payroll services | 162,999,401.81 |

| Advertising and related services | 12,516,835.91 |

| Photographic services | 31,700,776.22 |

| Veterinary services | 307,998,908.04 |

| Employment services | 8,632,797.51 |

| Travel arrangement and reservation services | 123,649,564.98 |

| Business support services | 62,452,661.16 |

| Investigation and security services | 111,515,983.82 |

| Services to buildings and dwellings | 193,500,496.15 |

| Other support services | 13,382,592.56 |

| Waste management and remediation services | 330,021,550.18 |

| Other private educational services | 891,340,062.14 |

| Home health care services | 1,546,765,903.47 |

| Nursing and residential care services | 3,397,449,653.63 |

| Child day care services | 808,617,979.05 |

| Individual and family services | 1,121,692,594.53 |

| Community food, housing, and other relief services, including rehabilitation services | 563,174,412.73 |

| Museum, heritage, zoo, and recreational services | 284,889,165.40 |

| Fitness and recreational sports center services | 276,610,671.04 |

| Bowling activities | 37,731,956.18 |

| Amusement parks, arcades, and gambling recreation | 1,362,597,003.94 |

| Other amusements and recreation | 452,265,174.87 |

| Hotels and motel services, including casino hotels | 1,080,754,135.13 |

| Other accommodation services | 317,417,135.72 |

| Restaurant, bar, and drinking place services | 8,167,417,678.83 |

| Car wash services | 122,648,652.79 |

| Personal and household goods repairs and maintenance | 164,685,312.51 |

| Personal care services | 1,119,569,484.71 |

| Death care services | 319,619,794.85 |

| Dry-cleaning and laundry services | 252,505,532.74 |

| Other personal services | 893,548,372.27 |

| Services from religious organizations | 1,063,426,886.56 |

| Grantmaking, giving, and social advocacy services | 1,396,370,405.20 |

| Civic, social, and professional services | 1,878,526,157.38 |

| Cooking, housecleaning, gardening, and other services to private households | 413,744,883.54 |

| Products and services of State & Local Govt enterprises (except electric utilities) | 960,069,265.37 |

| Sum Subject to Min. Wage Impact | 69,232,522,425.70 |

| 1% Price Increase | 692,325,224 |

[1] See “History of the Minimum Wage,” BeBusinessed.com, http://bebusinessed.com/history/history-of-minimum-wage/ (accessed October 1, 2016).

[2] Data is from the Occupational Employment Statistics. For an overview last updated March 30, 2016 see http://www.bls.gov/oes/oes_emp.htm#overview. To find the Arizona data used in this section of the report go to http://www.bls.gov/oes/current/oes_az.htm. This data is from May 2015 and represents the most recent data available.

[3] Belman, Dale and Paul J. Wolfson (2014), What Does the Minimum Wage Do? Kalamazoo, MI: W.E. Upjohn Institute for Employment Research, http://dx.doi.org/10.17848/9780880994583.

[4] This 15 percent figure for indirectly impacted workers is the assumption used by University of California-Berkeley model used later. It’s very similar to the assumption used by the Congressional Budget Office model referenced later and the estimates from the Economic Policy Institute discussed later in the paper.

[5] Hammond, George (2016), “Arizona’s 30-year Outlook: Surfing a Wave of Growth,” Economic Business Research Center, University of Arizona, Sept. 22, https://www.azeconomy.org/2016/09/featured/arizonas-30-year-outlook-surfing-a-wave-of-growth/ (accessed October 6, 2016) and “Arizona Job Growth,” Department of Numbers, http://www.deptofnumbers.com/employment/arizona/ (accessed October 6, 2016).

[6] For a broad overview of 200 studies since 2000 on the minimum wage see also Belman, Dale and Paul J. Wolfson (2014), What Does the Minimum Wage Do? Kalamazoo, MI: W.E. Upjohn Institute for Employment Research, http://dx.doi.org/10.17848/9780880994583.

[7] A very accessible review of the literature with an emphasis on this new body of research can be found in Schmitt, John (2015), “Explaining the Small Employment Effects of the Minimum Wage in the United States,” Industrial Relations, Vol. 54, No. 4, October, pp. 547-581.

[8] Congressional Budget Office (2014), “The Effects of a Minimum Wage Increase on Employment and Family Income, Feb. 18, https://www.cbo.gov/publication/44995 (accessed September 30, 2016).

[9] U.S. Bureau of Labor Statistics (2015), “Highlights of women’s earnings in 2014,” BLS Reports, Report 1058, November, Table 9, p. 32, http://www.bls.gov/opub/reports/womens-earnings/archive/highlights-of-womens-earnings-in-2014.pdf (accessed October 1, 2016).

[10] Roberts, Laurie (2016), “Arizona businesses body slam voters on minimum wage,” December 15, http://www.azcentral.com/story/opinion/op-ed/laurieroberts/2016/12/15/roberts-arizona-business-body-slams-voters-minimum-wage/95478264/, (accessed February 6, 2017).

[11] “Amicus Brief of Arizona Association of Providers for Persons with Developmental Disabilities (2017),” prepared by John R. Dacey and Christopher L. Hering for Arizona Chamber of Commerce et al v. State of Arizona and Arizonans for Fair Wages and Healthy Families Supporting Prop. 206,” January 13

[12] These changes in 2020 for a $12 min. wage are relative to what wage levels would have been in the absence of Prop. 206, not relative to Dec. 2016.

[13] Note cost increase is relative to what wages would have been in the absence of Prop. 206, not compared to Dec. 2016 wage levels.

[14] Currently the KidsCare state share is zero, but that expires in 2019, so this analysis assumes it returns to what it had been before which was a 23 percent state share.

[15] See 1931-Expanded category for the ACHCCS Population by Category Reports, for January 2017 found here https://www.azahcccs.gov/Resources/Downloads/PopulationStatistics/2017/Jan/AHCCCS_Population_by_Category.pdf (accessed February 7, 2017). That these are parents and not children is confirmed when looking at the AHCCCS Population Demographics, p. 2, which for October 2016 can be found here https://www.azahcccs.gov/Resources/Downloads/PopulationStatistics/2016/July/AHCCCS_Demographics.pdf (accessed February 7, 2017). The general resource page is https://www.azahcccs.gov/Resources/Reports/population.html. Assumes half of 150,000 category 37-100% of FPL are 67-100% of FPL.

[16] JLBC FY2017 Appropriations Report, p. 35.

[17] JLBC FY2017 Appropriation Report, p. 55, shows Child Expansion population as 80,000 for ages 6-17. Children 0-5 were already covered by Medicaid before passage of the Affordable Care Act, so, 5,000 children added to cover ages 0-5. See Pre-and Post ACA coverage details at “ObamaCare Medicaid Expansion,” http://obamacarefacts.com/obamacares-medicaid-expansion/ (accessed February 10, 2017).

[18] Assume that all households have someone in the labor force at these income levels. The Economic Policy Institute found 50-55% of earners in these households would be impacted by Prop. 206. Some households have multiple earners, so 60% of households impacted is used. The presumption at these income levels all households have someone in the labor force is based on their income level and that for Arizona in 2015 the Kaiser Family Foundation using Current Population Survey data finds that 79% of all Medicaid recipients (0-138% of the FPL), including children, are from households where someone is employed with 66% having a full-time worker. Almost all of those in households without employment income should be below 67% of the FPL. See “Distribution of the Nonelderly with Medicaid by Family Work Status,” http://kff.org/medicaid/state-indicator/distribution-by-employment-status-4/?dataView=0¤tTimeframe=0 (accessed February 7, 2017).

[19] For a family of three, the FPL is $21,000, so 67-100% of the FPL and 100-138% of the FPL equals approximately $7,000. If families are roughly equally distributed, then a $1,400 raise would move 20% of them out of the category.

[20] For adults and parents, the JLBC, FY2017 Appropriations Report was used where for 92,500 enrollees in adult expansion $463 million was the anticipated expense or about $5,000 per member. See pages 31 and 25. For children, the cost of KidsCare was used which came to about $2,500 per member. See Arizona Health Care Cost Containment System (2016), “Fiscal Impact of KidsCare Restoration,” January (prepared for House Committee hearing at Legislature) which found 35,000 enrollees would cost about $89 million.

[21] For Parents 67-100% of the FPL moving to the Expansion population from 31% to 10%. For Adults in Expansion Population from 10% to 0%. For Children moving to KidsCare from 31% to 23%.

[22] See Lemos, Sara (2008), “A Survey of the Effects of the Minimum Wage on Prices,” Journal of Economic Surveys, Vol 22, No. 1, pp. 187-212; .Fougere, Denis, Erwan Gautheir, Herve Le Bihan (2010), “Restaurant Prices and the Minimum Wage,” Journal of Money, Credit and Banking, Vol. 42, Nov. 7, October, pp. 1199-1234; and McDonald, James M. and Daniel Aaronson (2006), “How Firms Construct Price Changes: Evidence from Restaurant Responses to Increased Minimum Wages,” American Journal of Agricultural Economics, Vol. 88, pp. 292-307, http://naldc.nal.usda.gov/download/6852/PDF (accessed October 2, 2016).

[23] Fougere, Denis, Erwan Gautheir, Herve Le Bihan (2010), “Restaurant Prices and the Minimum Wage,” Journal of Money, Credit and Banking, Vol. 42, Nov. 7, October, pp. 1199-1234..

[24] Dube, Arindajit, T. William Lester, and Michael Reich (2014), “Minimum Wage Shocks, Employment Flows and Labor Market Frictions,” Institute for Research on Labor and Employment Working Paper #149-13, October, http://irle.berkeley.edu/files/2013/Minimum-Wage-Shocks-Employment-Flows-and-Labor-Market-Frictions.pdf (accessed February 10, 2017).

[25] Aaronson, Daniel and Eric French (2013), “How Does a Federal Minimum Wage Hike Affect Aggregate Household Spending?” Chicago Fed Letter, No. 313, August, https://www.chicagofed.org/publications/chicago-fed-letter/2013/august-313 (accessed February 8, 2017).