Healthcare

Healthcare

Arizona’s Medicaid Options under the Affordable Care Act: Fiscal and Economic Consequences

September 26, 2012The Grand Canyon Institute (GCI) evaluated the fiscal and economic circumstances of expanding Medicaid under the auspices of the Affordable Care Act of 2010 (ACA) versus continuing a freeze on coverage for single adults, but expanding coverage to all children under 133 percent of the Federal Poverty Line as required by the ACA, and also compared to fully funding the citizen-approved Proposition 204 “Healthy Arizona” Medicaid requirements while also expanding coverage to all children under 133 percent of the Federal Poverty Line as required in the ACA.

Option 1 continues the state’s current Medicaid coverage policies, but does add in coverage of children 6 to 18 years-olds to 133 percent of the Federal Poverty Line (FPL) as required by the ACA.

Option 2 would place the state in compliance with Prop. 204 “Healthy Arizona” eligibility levels of 100 percent of the FPL as well as the broader coverage for children in Option 1.

Option 3 would mean full state compliance with the Medicaid eligibility requirements of 133 percent of the FPL.

Policy Paper

September 26, 2012

Arizona’s Medicaid Options under the Affordable Care Act: Fiscal and Economic Consequences

Dave Wells, Ph.D.

Research Director, Grand Canyon Institute

Executive Summary

The Grand Canyon Institute (GCI) evaluated the fiscal and economic circumstances of expanding Medicaid under the auspices of the Affordable Care Act of 2010 (ACA) versus continuing a freeze on coverage for single adults, but expanding coverage to all children under 133 percent of the Federal Poverty Line as required by the ACA, and also compared to fully funding the citizen-approved Proposition 204 “Healthy Arizona” Medicaid requirements while also expanding coverage to all children under 133 percent of the Federal Poverty Line as required in the ACA.

Option 1 continues the state’s current Medicaid coverage policies, but does add in coverage of children 6 to 18 years-olds to 133 percent of the Federal Poverty Line (FPL) as required by the ACA.

Option 2 would place the state in compliance with Prop. 204 “Healthy Arizona” eligibility levels of 100 percent of the FPL as well as the broader coverage for children in Option 1.

Option 3 would mean full state compliance with the Medicaid eligibility requirements of 133 percent of the FPL.

Table 1

| Added Coverage Medicaid Cost Summaries for FY2014 to FY2017 | |||

| State Costs | Federal Funding | 2017 Lives Covered | |

| Option 1-not complying with Healthy Arizona (freeze on childless adults) | $855,559,239 | $2,758,704,003 | 228,607 |

| Option 2-Healthy Arizona Compliance (100% of FPL) | 2,733,940,716 | 6,353,462,027 | 417,234 |

| Option 3-Full Compliance with ACA (133% of FPL) | 1,520,422,753 | 7,932,760,353 | 434,855 |

Table 1 illustrates that while Option 1 is the cheapest option for the state, it would mean dramatically less federal funding coming into the state and about 200,000 fewer people covered. In addition, Option 1 will create a gap population for childless adults under the poverty line who do not qualify for Medicaid, but do not earn enough income to receive subsidies in the exchanges. Option 3 costs the state $1.2 billion less than Option 2, provides about $1.6 billion more in federal funding and provides health coverage for about 17,000 more Arizonans in 2017 compared to Option 2.

The significant differences in Federal funding arises due to enhanced Federal matching funds that are available to the state by choosing Option 3, applied to childless adults below 100 percent of the FPL as well as covering all adults between 100 and 133 percent of the FPL. Option 2 would limit Arizona to its current 65.68 percent Federal funding except for many of the children covered up to 133 percent of the FPL. The holds true for Option 1 as well.

However, the economic impacts are greater than what’s implied in Table 1. GCI also conducted a multiplier analysis of how the added federal funds would impact Arizona’s economy. The revenue structures of the ACA are the same in all three options, so the key difference economically is the added Federal dollars in Option 2 and Option 3. GCI used FY2015, the first year of full ACA implementation, however, so as to create estimates that were more attuned to long-term impacts, when estimating Option 3, rather than use the 100 percent federal funding for adults between 100 and 133 percent of the FPL, GCI reduced this to 90 percent with a 10 percent state match to align with how the ACA will be funded from 2020 onward. GCI found the output multiplier to be 1.85, meaning that for every new dollar in federal funding, the state’s economy grows by $1.85. Likewise, for every job created by the initial inflow of Federal funds, the multiplier effect yielded nearly one additional job, giving a total of 1.97 jobs.

Table 2 illustrates that compared to current policy (Option 1), Option 3 will create 21,000 new jobs compared to 15,000 new jobs with Option 2, and the state’s economy will grow by $2.8 billion instead of nearly $2 billion.

Table 2

| Economic Impact of Options 2 and 3 Compared to Option 1 (current policy) | ||

| One Year Change | Option 2:Restore Childless Adults

100% FPL Medicaid |

Option 3:Full ACA Implemented

133% FPL Medicaid |

| Added Jobs | 14,952 | 21,003 |

| Added Growth | $1.976 Billion | $2.776 Billion |

*Children 6-18 through 133 percent of FPL covered in all cases

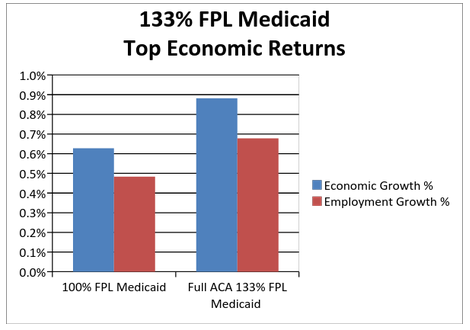

Figures 1 and 2 illustrate these effects as well. As the state’s economic output in 2015 will be approximately $315 billion, choosing option 2 increases economic growth by 0.6 percent, while Option 3 enhances growth by 0.9 percent. Employment growth will reduce the state’s unemployment rate under Option 2 by 0.5 percent and 0.7 percent under Option 3. Hence, Option 3 provides the most benefit to the state’s economy.

Figure 1

Figure 2 illustrates the cost to the state after taking into account the added tax revenues that economic growth generates. For these estimates, State and Local tax revenues are combined, so these are not net costs to the State’s General Fund, but net costs to State and Local government. Here Option 2 costs close to half a billion in 2015, and Option 3, with the assumption that the state pays 10 percent of the added coverage , as a net cost of $160 million, one-third less. Thus choosing, Option 3 is also a wiser choice for the fiscal future of state and local governments compared to Option 2.

Analyzing these three scenarios, GCI finds that the most prudent pathway would be for the state to choose Option 3, full ACA Medicaid eligibility compliance. Option 1 does cost the state less, but comes at significant losses to the state’s economic growth and employment picture, and also creates a gap population of single adults, ineligible for Medicaid and too poor to qualify for exchange subsidies.

Option 2 provides less coverage at greater cost to the state, while providing less economic growth and job creation than Option 3, making Option 3, the clear preferred pathway for Arizona.

Figure 2

Introduction

With the recent Supreme Court Decision in National Federation of Independent Business v. Sebelius (NFIB), states have been granted the choice of participating in the Medicaid eligibility expansion. The Grand Canyon Institute compiled reports to develop an analysis of the economic and fiscal ramifications of different coverage levels for Arizona.

The policy analysis is based on the following statements of fact:

- Prop. 204 “Healthy Arizona” passed by voters in 2000 extended Medicaid coverage in the state to everyone up to 100 percent of the federal poverty line (FPL). During the recent state budget crisis and due to ambiguity in the wording of Prop. 204, the state received approval from the federal government to freeze new enrollment for childless adults. However, the freeze was supposed to be temporary. Should the state fail to reinstate coverage as fiscal times improve, we can expect advocacy organizations to sue and likely prevail. Nonetheless, for our analysis we presume that not fully funding “Healthy Arizona” requirements is an option for the state. However, childless adults below 100 percent of the FPL would not be eligible for insurance coverage under the exchange, and would effectively become a gap population, not eligible for Medicaid or insurance under the exchange under this scenario. The state also froze enrollment in KidsCare, Arizona’s Children’s Health Insurance Program (CHIP). For purposes of this analysis, we focus only on those children eligible for KidsCare up to 133 percent of the FPL who under the ACA now will qualify for Medicaid, even if Arizona does not otherwise extend Medicaid coverage.

- Arizonans between 100 and 133 percent of the FPL are not subject to the surcharge/tax for failing to have health insurance, and would be eligible to purchase insurance with a premium of two percent of their income at the “silver” level of the insurance exchange. If followed, due to Prop. 204, “Healthy Arizona,” the state of Arizona does not have a coverage gap, if Medicaid eligibility is not fully expanded here. However, if forced to purchase insurance in the exchange, we expect fewer to participate than if they qualified for Medicaid, since they would be responsible for paying a premium equal to two percent of their income plus modest cost-sharing in their use of health care.

- If Arizona expands Medicaid coverage to the standards of the Affordable Care Act (ACA), the federal government will pay nearly 100 percent of the cost of those newly eligible, and the federal government will cut the amount the state currently pays for Medicaid for childless adults nearly in half and replace it with added federal dollars. If Arizona does not expand Medicaid, then Arizona will not be eligible for the enhanced match for childless adults.

- Tax changes from the Affordable Care Act will take effect regardless of whether Arizona expands Medicaid coverage. Hence, GCI treats new federal funds coming into the state as a net gain for Arizona in determining economic impacts when comparing outcomes between expanding Medicaid coverage eligibility or not doing so.

- Because ACA was designed to expand insurance coverage, funds noted as Disproportionate Share Hospital Payments (DSH), which were designed to help compensate hospitals for caring for uncovered indigent populations, are cut substantially. These cuts take place regardless of whether Arizona chooses to expand Medicaid eligibility or not.

How Medicaid and KidsCare work financially in Arizona

Currently the Federal government picks up about 66 percent of the cost of the Medicaid eligible in Arizona. Hence, the state pays about one-third the cost of Medicaid and one-four of the cost of KidsCare. Unlike Medicaid, KidsCare is a premium-based program, where parents based on income level pay a health insurance premium of up to $50 per month for a child, and no more than $70 per month for multiple children. Premiums may not exceed five percent of family income. The recent action by Hospitals to provide private funding for KidsCare II for children on the KidsCare waiting list between 100 and 175 percent of the FPL through December 31, 2013 acts as a KidsCare bridge to the implementation point of expanded Medicaid under the ACA. At the time of the KidsCare enrollment freeze, the state placedll children formerly on KidsCare who are eligible for Medicaid on Medicaid (AHCCCS) due to being in households less than 100 percents of the FPL.

When the ACA takes effect and Medicaid expands for children 6 to 18 years old, then those children on KidsCare or KidsCare II who now qualify for Medicaid will retain their enhanced KidsCare match as they transfer. Children qualifying for Medicaid, not on KidsCare, will receive the traditional Federal Medical Assistance Percentage (FMAP).

Source of Estimated AHCCCS Enrollments

For cost estimates GCI uses estimates developed by AHCCCS as of August 1, 2012 for fiscal years 2014 through 2017. AHCCCS assumes a 3 to 5.5 percent annual health care inflation and after a gradual enrollment period between January and July of 2014, that enrollment increases by 1.5 to 2.25 percent depending on the population. All of these growth assumptions seem reasonable. Health Care inflation has typically outpaced the general inflation index, and the Congressional Budget Office forecasts Medicaid enrollee inflation to be about 5 percent annually from 2014-2017. Given that the rate of growth in AHCCCS should diminish as the economy gradually improves and presently population growth in the state has subsided, this range for expected enrollment growth once ACA phases in seems sensible.

Option 1: Not Complying with “Healthy Arizona”: Enrollment freeze on childless adults, but expand child coverage as required by the ACA

Under this scenario, the state maintains its current practice of freezing coverage for childless adults. These are adults without children eighteen years or younger living with them. The state would receive its current FMAP payment, except for retaining a higher KidsCare FMAP for those children who would now qualify for Medicaid. The ACA makes all children up to 133 percent of the FPL, Medicaid eligible.

AHCCCS presumes that 70 percent of newly eligible individuals will enroll and that 50 percent of those currently eligible but not enrolled will enroll, the so-called “woodwork” effect. ACA is designed to create a one-stop shop, so those exploring insurance options will also be evaluated for Medicaid eligibility and income definitions will now be consistent across Federal programs and the Exchanges. Even though populations under 133 percent of the FPL are not financially sanctioned for not participating, they are more likely to enroll under these circumstances than they are presently. Hence, a “woodwork” effect is forecast regardless of whether or not Arizona chooses to expand Medicaid coverage.

Because under this scenario, Arizona is not expanding Medicaid to match the requirements of the ACA, the federal percentage paid is 66 percent for all populations, as it is under the current Medicaid program. The only exception would be children currently enrolled in KidsCare or KidsCare II who become eligible for Medicaid as Medicaid will expand children’s eligibility through age 18, up from age 5 currently. Those children transferring to Medicaid from KidsCare or KidsCare II will received the enhanced KidsCare FMAP. Hence, the percentage Federal Share under the category “Mandatory Child Expansion” is in between the regular FMAP, 65.68 percent and the enhanced FMAP for the Children’s Health Insurance Program of 76.10 percent.

Childless adults under the FPL under Option 1 would not be eligible for Medicaid, nor would they be in a group eligible for subsidies in the Exchange, and would become a gap population without coverage.

If Arizona does not expand Medicaid eligibility, then adults in households between 100 and 133 percent of the FPL who do not have employer insurance could purchase it through the exchange at a limit of 2 percent of income for the premium with additional cost-sharing. Based on research by Coughlin and Ku which examined programs in states that offered insurance to low income working families, a premium of 2 percent of income will engender a 50 percent participation rate among those uninsured, rather than a 70 percent participation rate, which would be expected for Medicaid participation with no premium. For GCI’s calculations, the amount of the exchange subsidy was estimated based on Congressional Budget Office research. In 2009, CBO estimated for an income of 125 percent of FPL, in 2016 the subsidy for the premium plus cost-sharing (the plans are designed to have the enrollee pay 30 percent of health costs on average and the subsidies reduce that) would be $6,000. In a 2012 CBO analysis, in 2022, they noted the typical subsidy for an adult participant between 100 and 138 percent of FPL would be about $9,333, comparing that to their average expected subsidy across for 2022, indicated that this low income subsidy would be 1.24 times greater than the average subsidy. Using that ratio for earlier years resulted in numbers that though slightly higher seemed consistent with the 2009 CBO analysis, and are used here.

We assume all those enrolling in the exchanges in this income group did not have insurance. In 2010 the Census Bureau’s Current Population Survey found only 3.6 percent of Arizonans with incomes less than 138 percent of the FPL in 2010 had private health coverage through private purchase, not through an employer, while 40 percent were uninsured.

Option 1 Outcomes:

Cumulative Cost to the State General Fund 2014-2017: 855,559,239

Cumulative Inflow of Federal Dollars 2014-2017: 2,758,704,003

Additional Lives Covered & Enrolled by 2017: 228,607

Table 3

| Option 1: Not Complying with “Healthy Arizona”: Enrollment freeze on single adults, but expands child coverage as required by the ACA | |||||

| Woodwork from Federal Mandatory Categories (Children, SSI, Parents <100% FPL) | |||||

| FY 2014 | FY 2015 | FY 2016 | FY 2017 | TOTAL | |

| State Match | 70,454,567 | 209,287,822 | 225,144,176 | 237,030,874 | 741,917,439 |

| Federal Share | 134,832,633 | 400,525,178 | 430,870,324 | 453,618,526 | 1,419,846,661 |

| Total | 205,287,200 | 609,813,000 | 656,014,500 | 690,649,400 | 2,161,764,100 |

| Lives Covered | 98,667 | 133,838 | 136,859 | 139,840 | |

| Mandatory Child Expansion (6-18 100-138% FPL)-under 6 already covered | |||||

| State Match | 9,846,500 | 36,865,800 | 33,574,700 | 33,354,800 | 113,641,800 |

| Federal Share | 23,621,300 | 80,323,000 | 91,300,400 | 97,351,700 | 292,596,400 |

| Total | 33,467,800 | 117,188,800 | 124,875,100 | 130,706,500 | 406,238,200 |

| Lives Covered | 33,823 | 43,349 | 44,042 | 44,716 | |

| Combined Mandatory Elements | |||||

| State Match | 80,301,067 | 246,153,622 | 258,718,876 | 270,385,674 | 855,559,239 |

| Federal Share | 158,453,933 | 480,848,178 | 522,170,724 | 550,970,226 | 1,712,443,061 |

| Total | 238,755,000 | 727,001,800 | 780,889,600 | 821,355,900 | 2,568,002,300 |

| FY 2014 | FY 2015 | FY 2016 | FY 2017 | TOTAL | |

| Childless Adult Freeze Reinstated (<100% FPL) | |||||

| State Match | 0 | 0 | 0 | 0 | 0 |

| Federal Share | 0 | 0 | 0 | 0 | 0 |

| Total | 0 | 0 | 0 | 0 | 0 |

| Lives Covered | 0 | 0 | 0 | 0 | |

| Childless Adults Woodwork (<100% FPL) | |||||

| State Match | 0 | 0 | 0 | 0 | 0 |

| Federal Share | 0 | 0 | 0 | 0 | 0 |

| Total | 0 | 0 | 0 | 0 | 0 |

| Lives Covered | 0 | 0 | 0 | 0 | |

| Combined Prop. 204 Compliance | |||||

| State Match | 0 | 0 | 0 | 0 | 0 |

| Federal Share | 0 | 0 | 0 | 0 | 0 |

| Total | 0 | 0 | 0 | 0 | 0 |

| Total Impacts | |||||

| State Match | 80,301,067 | 246,153,622 | 258,718,876 | 270,385,674 | 855,559,239 |

| Federal Share | 158,453,933 | 480,848,178 | 522,170,724 | 550,970,226 | 1,712,443,061 |

| Total | 238,755,000 | 727,001,800 | 780,889,600 | 821,355,900 | 2,568,002,300 |

| Lives Covered | 132,490 | 177,187 | 180,901 | 184,556 | |

| FY 2014 | FY 2015 | FY 2016 | FY 2017 | TOTAL | |

| Insurance Exchange Participants Adults (100-138% FPL) | |||||

| Avg. Federal Subsidy | 6,600 | 6,670 | 6,810 | 6,990 | |

| Enrollees | 29,015 | 42,164 | 43,121 | 44,051 | |

| Total Federal Share | 191,499,000 | 281,235,786 | 293,652,064 | 307,919,486 | 1,074,306,336 |

| Disproportionate Hospital Share Funding | |||||

| -5% | -5% | -5% | -16% | ||

| Federal Share | -4,523,451 | -4,523,451 | -4,523,451 | -14,475,042 | -28,045,393 |

| Total Federal Dollars | 345,429,482 | 757,560,514 | 811,299,337 | 844,414,670 | 2,758,704,003 |

| Covered+Enrollees | 161,505 | 219,351 | 224,022 | 228,607 | |

Based on Calculations by AHCCCS, August 1, 2012 Fiscal Year 2014 to Fiscal Year 2017 Cost Summary by Eligibility. Disproportionate Hospital Share Funding follows same match as Medicaid. Total and estimated future reductions from JLBC and Kaiser Commission on Medicaid and Uninsured and Urban Institute. Insurance Exchange calculations by author based on Congressional Budget Office estimates.

Option 2: Arizona meets “Healthy Arizona” requirements plus expanded child coverage as required by the ACA

Under this scenario GCI expects under Prop. 204 “Healthy Arizona” from 2000 that the state will reinstate coverage of childless adults by 2014. As with all government programs, not everyone eligible enrolls. AHCCCS presumes that 70 percent of newly eligible individuals will enroll and that 50 percent of those currently eligible but not enrolled will enroll, the so-called “woodwork” effect. ACA is designed to create a one-stop shop, so those exploring insurance options will also be evaluated for Medicaid eligibility and income definitions will now be consistent across Federal programs and the Exchanges. Populations under 133 percent of the FPL are not financially sanctioned for not participating, they are more likely to enroll under these circumstances than they are presently. Hence, a “woodwork” effect is forecast regardless of whether or not Arizona chooses to expand Medicaid.

Because under this scenario, Arizona is not expanding Medicaid to match the requirements of the ACA, the federal percentage paid is 66 percent for all populations, as it is under the current Medicaid program. The only exception would be children currently enrolled in KidsCare or KidsCare II who become eligible for Medicaid as Medicaid will expand children’s eligibility through age 18, up from age 5 currently. Those children transferring to Medicaid from KidsCare or KidsCare II will received the enhanced KidsCare FMAP. Hence, the percentage Federal Share under the category “Mandatory Child Expansion” is in between the regular FMAP, 65.68 percent and the enhanced FMAP for the Children’s Health Insurance Program of 76.10 percent.

As noted earlier, due to not fully complying with the Medicaid eligibility expansion, under Option 2, Arizona would not receive an enhanced FMAP for childless adults.

Option 2 Outcomes:

Cumulative Cost to the State General Fund 2014-2017: 2,733,940,716

Cumulative Inflow of Federal Dollars 2014-2017: 6,353,462,027

Additional Lives Covered & Enrolled by 2017: 417,234

Table 4

| Option 2: Arizona meets “Healthy Arizona” requirements plus expanded child coverage as required by the ACA | |||||

| Woodwork from Federal Mandatory Categories (Children, SSI, Parents <100% FPL) | |||||

| FY 2014 | FY 2015 | FY 2016 | FY 2017 | TOTAL | |

| State Match | 70,454,567 | 209,287,822 | 225,144,176 | 237,030,874 | 741,917,439 |

| Federal Share | 134,832,633 | 400,525,178 | 430,870,324 | 453,618,526 | 1,419,846,661 |

| Total | 205,287,200 | 609,813,000 | 656,014,500 | 690,649,400 | 2,161,764,100 |

| Lives Covered | 98,667 | 133,838 | 136,859 | 139,840 | |

| Mandatory Child Expansion (6-18 100-138% FPL)-under 6 already covered | |||||

| State Match | 9,846,500 | 36,865,800 | 33,574,700 | 33,354,800 | 113,641,800 |

| Federal Share | 23,621,300 | 80,323,000 | 91,300,400 | 97,351,700 | 292,596,400 |

| Total | 33,467,800 | 117,188,800 | 124,875,100 | 130,706,500 | 406,238,200 |

| Lives Covered | 33,823 | 43,349 | 44,042 | 44,716 | |

| Combined Mandatory Elements | |||||

| State Match | 80,301,067 | 246,153,622 | 258,718,876 | 270,385,674 | 855,559,239 |

| Federal Share | 158,453,933 | 480,848,178 | 522,170,724 | 550,970,226 | 1,712,443,061 |

| Total | 238,755,000 | 727,001,800 | 780,889,600 | 821,355,900 | 2,568,002,300 |

| FY 2014 | FY 2015 | FY 2016 | FY 2017 | TOTAL | |

| Childless Adult Freeze Reinstated (<100% FPL) | |||||

| State Match | 96,298,763 | 461,077,463 | 486,813,928 | 501,418,495 | 1,545,608,647 |

| Federal Share | 184,292,037 | 882,388,337 | 931,641,572 | 959,591,105 | 2,957,913,053 |

| Total | 280,590,800 | 1,343,465,800 | 1,418,455,500 | 1,461,009,600 | 4,503,521,700 |

| Lives Covered | 108,010 | 154,300 | 154,300 | 154,300 | |

| Childless Adults Woodwork (<100% FPL) | |||||

| State Match | 20,154,420 | 97,217,509 | 104,930,208 | 110,470,692 | 332,772,829 |

| Federal Share | 38,570,580 | 186,050,291 | 200,810,492 | 211,413,608 | 636,844,971 |

| Total | 58,725,000 | 283,267,800 | 305,740,700 | 321,884,300 | 969,617,800 |

| Lives Covered | 22,606 | 32,854 | 33,595 | 34,327 | |

| Combined Prop. 204 Compliance | |||||

| State Match | 116,453,183 | 558,294,972 | 591,744,136 | 611,889,186 | 1,878,381,476 |

| Federal Share | 222,862,617 | 1,068,438,628 | 1,132,452,064 | 1,171,004,714 | 3,594,758,024 |

| Total | 339,315,800 | 1,626,733,600 | 1,724,196,200 | 1,782,893,900 | 5,473,139,500 |

| Total Impacts | |||||

| State Match | 196,754,250 | 804,448,593 | 850,463,012 | 882,274,861 | 2,733,940,716 |

| Federal Share | 381,316,550 | 1,549,286,807 | 1,654,622,788 | 1,721,974,939 | 5,307,201,084 |

| Total | 578,070,800 | 2,353,735,400 | 2,505,085,800 | 2,604,249,800 | 8,041,141,800 |

| Lives Covered | 263,106 | 364,341 | 368,796 | 373,183 | |

| FY 2014 | FY 2015 | FY 2016 | FY 2017 | TOTAL | |

| Insurance Exchange Participants Adults (100-138% FPL) | |||||

| Avg. Federal Subsidy | 6,600 | 6,670 | 6,810 | 6,990 | |

| Enrollees | 29,015 | 42,164 | 43,121 | 44,051 | |

| Total Federal Share | 191,499,000 | 281,235,786 | 293,652,064 | 307,919,486 | 1,074,306,336 |

| Disproportionate Hospital Share Funding | |||||

| -5% | -5% | -5% | -16% | ||

| Federal Share | -4,523,451 | -4,523,451 | -4,523,451 | -14,475,042 | -28,045,393 |

| Total Federal Dollars | 568,292,100 | 1,825,999,142 | 1,943,751,401 | 2,015,419,383 | 6,353,462,027 |

| Covered+Enrollees | 292,121 | 406,505 | 411,917 | 417,234 | |

Based on Calculations by AHCCCS, August 1, 2012 Fiscal Year 2014 to Fiscal Year 2017 Cost Summary by Eligibility. Disproportionate Hospital Share Funding follows same match as Medicaid. Total and estimated future reductions from JLBC and Kaiser Commission on Medicaid and Uninsured and Urban Institute. Insurance Exchange calculations by author based on Congressional Budget Office estimates.

Option 3: Arizona expands Medicaid eligibility in compliance with the ACA

If Arizona expands Medicaid eligibility, then due to Proposition 204 which greatly expanded Medicaid coverage in the state, the state is in a special category, so as not to be penalized for having a more generous Medicaid program than many other states. Arizona would receive an enhanced Federal share funding for childless adults under 100 percent of the FPL. Instead of paying two-thirds the cost the Federal Government would pay in excess of four-fifths of the cost working toward 90 percent of the cost. The exact cost percentages covered by the Federal government are listed below:

2014 82.84%

2015 86.27%

2016 89.70%

2017 89.14%

2018 91.17%

2019 93.0%

2020+ 90%

In addition, the coverage of all individuals between 100 and 138 percent of the FPL would be 100 percent initially, eventually decreasing in 2020 to 90 percent.

2014 100%

2015 100%

2016 100%

2017 95%

2018 94%

2019 93%

2020+ 90%

The result is that even though the state covers more people in its Medicaid program, additional state funding for health care is cut about 40 percent compared to Option 2 and the inflow of Federal dollars rises by about 25 percent over Option 2.

Option 3 Outcomes:

Cumulative Cost to the State General Fund 2014-2017: 1,520,422,753

Cumulative Inflow of Federal Dollars 2014-2017: 7,932,760,353

Additional Lives Covered & Enrolled by 2017: 434,855

Table 5

| Option 3: Arizona expands Medicaid eligibility in compliance with the ACA | |||||

| Woodwork from Federal Mandatory Categories (Children, SSI, Parents <100% FPL) | |||||

| FY 2014 | FY 2015 | FY 2016 | FY 2017 | TOTAL | |

| State Match | 70,454,567 | 209,287,822 | 225,144,176 | 237,030,874 | 741,917,439 |

| Federal Share | 134,832,633 | 400,525,178 | 430,870,324 | 453,618,526 | 1,419,846,661 |

| Total | 205,287,200 | 609,813,000 | 656,014,500 | 690,649,400 | 2,161,764,100 |

| Lives Covered | 98,667 | 133,838 | 136,859 | 139,840 | |

| Mandatory Child Expansion (6-18 100-138% FPL)-under 6 already covered | |||||

| State Match | 9,846,500 | 36,865,800 | 33,574,700 | 33,354,800 | 113,641,800 |

| Federal Share | 23,621,300 | 80,323,000 | 91,300,400 | 97,351,700 | 292,596,400 |

| Total | 33,467,800 | 117,188,800 | 124,875,100 | 130,706,500 | 406,238,200 |

| Lives Covered | 33,823 | 43,349 | 44,042 | 44,716 | |

| Combined Mandatory Elements | |||||

| State Match | 80,301,067 | 246,153,622 | 258,718,876 | 270,385,674 | 855,559,239 |

| Federal Share | 158,453,933 | 480,848,178 | 522,170,724 | 550,970,226 | 1,712,443,061 |

| Total | 238,755,000 | 727,001,800 | 780,889,600 | 821,355,900 | 2,568,002,300 |

| FY 2014 | FY 2015 | FY 2016 | FY 2017 | TOTAL | |

| Childless Adult Freeze Reinstated (<100% FPL) | |||||

| State Match | 48,149,381 | 184,430,985 | 146,044,178 | 158,724,083 | 537,348,628 |

| Federal Share | 232,441,419 | 1,159,034,815 | 1,272,411,322 | 1,302,285,517 | 3,966,173,072 |

| Total | 280,590,800 | 1,343,465,800 | 1,418,455,500 | 1,461,009,600 | 4,503,521,700 |

| Lives Covered | 108,010 | 154,300 | 154,300 | 154,300 | |

| Childless Adults Woodwork (<100% FPL) | |||||

| State Match | 10,077,210 | 38,887,004 | 31,479,062 | 34,969,510 | 115,412,786 |

| Federal Share | 48,647,790 | 244,380,796 | 274,261,638 | 286,914,790 | 854,205,014 |

| Total | 58,725,000 | 283,267,800 | 305,740,700 | 321,884,300 | 969,617,800 |

| Lives Covered | 22,606 | 32,854 | 33,595 | 34,327 | |

| Combined Prop. 204 Compliance | |||||

| State Match | 58,226,591 | 223,317,989 | 177,523,241 | 193,693,593 | 652,761,414 |

| Federal Share | 281,089,209 | 1,403,415,611 | 1,546,672,959 | 1,589,200,307 | 4,820,378,086 |

| Total | 339,315,800 | 1,626,733,600 | 1,724,196,200 | 1,782,893,900 | 5,473,139,500 |

| FY 2014 | FY 2015 | FY 2016 | FY 2017 | TOTAL | |

| Adult Parent Expansion (100-138% FPL) | |||||

| State Match | 0 | 0 | 0 | 7,709,900 | 7,709,900 |

| Federal Share | 55,567,500 | 268,027,400 | 289,280,800 | 296,850,100 | 909,725,800 |

| Total | 55,567,500 | 268,027,400 | 289,280,800 | 304,560,000 | 917,435,700 |

| Lives Covered | 28,435 | 41,322 | 42,259 | 43,171 | |

| Childless Adult Expansion (100-138% FPL) | |||||

| State Match | 0 | 0 | 0 | 4,392,200 | 4,392,200 |

| Federal Share | 31,656,300 | 152,692,400 | 164,799,600 | 169,110,500 | 518,258,800 |

| Total | 31,656,300 | 152,692,400 | 164,799,600 | 173,502,700 | 522,651,000 |

| Lives Covered | 12,186 | 17,708 | 18,110 | 18,501 | |

| Combined ACA Expanded Adult (childless and parents) | |||||

| State Match | 0 | 0 | 0 | 12,102,100 | 12,102,100 |

| Federal Share | 87,223,800 | 420,719,800 | 454,080,400 | 465,960,600 | 1,427,984,600 |

| Total | 87,223,800 | 420,719,800 | 454,080,400 | 478,062,700 | 1,440,086,700 |

| TOTAL | |||||

| State Match | 138,527,658 | 469,471,610 | 436,242,117 | 476,181,367 | 1,520,422,753 |

| Federal Share | 526,766,942 | 2,304,983,590 | 2,522,924,083 | 2,606,131,133 | 7,960,805,747 |

| Total | 665,294,600 | 2,774,455,200 | 2,959,166,200 | 3,082,312,500 | 9,481,228,500 |

| Lives Covered | 303,727 | 423,371 | 429,165 | 434,855 | |

| Disproportionate Hospital Share Funding | |||||

| -5% | -5% | -5% | -16% | ||

| Federal Share | -4,523,451 | -4,523,451 | -4,523,451 | -14,475,042 | -28,045,393 |

| Total Federal Dollars | 522,243,491 | 2,300,460,139 | 2,518,400,632 | 2,591,656,091 | 7,932,760,353 |

| Covered+Enrollees | 303,727 | 423,371 | 429,165 | 434,855 | |

Based on Calculations by AHCCCS, August 1, 2012 Fiscal Year 2014 to Fiscal Year 2017 Cost Summary by Eligibility. Disproportionate Hospital Share Funding follows same match as Medicaid. Total and estimated future reductions from JLBC and Kaiser Commission on Medicaid and Uninsured and Urban Institute.

Comparing the Economic Impacts of Option 2 and Option 3 Relative to Option 1

GCI takes the first year of full implementation of the ACA, Fiscal Year 2015, to estimate economic impacts of Option 2 and Option 3 relative to Option 1.

Regardless of whether the state expands Medicaid eligibility or not, simply by complying with Prop. 204, the state will receive a significant inflow of federal funds beyond what it is currently receiving. GCI uses the current policy Option 1 as the base, and then compares the impact of the added federal funding in Option 2 and Option 3, and how that might impact economic growth and job creation. Because 2015 is still part of the fiscal phase in of the ACA, GCI adjusted Option 3 to the full phase-in Federal inflow, when the state will need to pick up 10 percent of the cost of newly eligible adults between 100 and 133 percent of the FPL. That way the estimates can be more generally applied, not just for FY2015.

Base Line Option 1: Federal Inflow of Funds $757,560,514

Option 2: Federal Inflow of Funds $1,825,999,142

Option 3: Federal Inflow of Funds $2,300,460,139

Option 3: Federal Inflow of Funds (adjusted) $2,258,388,159

To estimate the economic impact of the three options, GCI used IMPLAN software with a series of Input-Output economic equations for Arizona designed to simulate the way different sectors of the economy interact with each other to create jobs, economic growth as well as tax revenues. Direct effects are the results of the initial expenditures noted above. Part of those direct effects go to wages and part goes to non-wage costs. The multiplier effect throughout Arizona of the non-wage costs, IMPLAN calls the indirect effect, and the multiplier effect due to subsequent spending of employees is the induced effect.

Based on data from Centers for Medicare & Medicaid Services, Arizona has a largely HMO-based system, with 86 percent of Medicaid funds paid through that means, 13.2 percent paid to hospitals and 0.4 percent to private physicians and 0.4 percent to nursing facilities. Thus, direct effects were broken into these sectors accordingly.

The IMPLAN economic growth multiplier is 1.85 and the jobs multiplier is 1.97 for Arizona, meaning for every added dollar in federal funding, the state’s economy grows by $1.85, and for every job created by direct spending, total employment in the state grows by 1.97 jobs.

Option 2:

Cost to State and Local Governments Beyond Option 1: $558,294,971

Net Cost after including growth-generated Government Revenues: $483,313,763

Increase in State Economic Growth: +0.6 percent

Increase in State Employment Rate (decrease in Unemployment): +0.5 percent

Table 6

| Option 2: Economic Impacts | ||||||

| Impact Type | Employment | Labor Income | Value Added | Output | State & Local TaxGenerated | |

| Direct Effect | 7,570.7 | $490,882,100 | $596,629,864 | $1,068,438,628 | $23,609,009 | |

| Indirect Effect | 2,927.0 | $140,527,987 | $230,935,725 | $366,605,057 | $16,834,926 | |

| Induced Effect | 4,454.3 | $187,092,380 | $340,874,930 | $541,301,356 | $34,537,273 | |

| Total Effect | 14,952.1 | $818,502,466 | $1,168,440,519 | $1,976,345,041 | $74,981,208 | |

Option 3

Cost to State and Local Governments Beyond Option 1: $223,317,988

Net Cost after including growth-generated Government Revenues: $115,039,915

Table 7

| Option 3: Economic Impacts | ||||||

| Impact Type | Employment | Labor Income | Value Added | Output | State & Local Tax

Generated |

|

| Direct Effect | 10,932.7 | $708,867,864 | $861,574,984 | $1,542,899,626 | $34,093,049 | |

| Indirect Effect | 4,226.8 | $202,932,178 | $333,487,235 | $529,403,178 | $24,310,802 | |

| Induced Effect | 6,432.4 | $270,174,397 | $492,247,087 | $781,676,773 | $49,874,222 | |

| Total Effect | 21,591.9 | $1,181,974,439 | $1,687,309,306 | $2,853,979,577 | $108,278,073 | |

Option 3 (90% Federal Funding Scenario for expanded populations)

Because GCI wants a representative annual impact, rather than strictly FY2015, GCI reduced the federal inflow. In FY 2015, the federal government will take on 100 percent of the costs of added adult Medicaid coverage between 100 and 133 percent of the FPL. However, by 2020, this coverage will fall to 90 percent of the cost. So for purposes of determining the economic benefit of Options 3 more generally, GCI assumed that Arizona had to pick up 10 percent of the cost of covering these expanded populations.

Cost to State and Local Governments Beyond Option 1: $265,389,968

Net Cost after including growth-generated Government Revenues: $160,064,436

Increase in State Economic Growth: +0.9 percent

Increase in State Employment Rate (decrease in Unemployment): +0.7 percent

Table 8

| Adjusted Option 3 (90% Federal Funding Scenario for expanded populations) | ||||||

| Impact Type | Employment | Labor Income | Value Added | Output | State & Local Tax

Generated |

|

| Direct Effect | 10,634.6 | $689,538,366 | $838,081,449 | $1,500,827,645 | $33,163,395 | |

| Indirect Effect | 4,111.6 | $197,398,598 | $324,393,663 | $514,967,346 | $23,647,893 | |

| Induced Effect | 6,257.0 | $262,807,248 | $478,824,432 | $760,361,913 | $48,514,244 | |

| Total Effect | 21,003.1 | $1,149,744,212 | $1,641,299,544 | $2,776,156,904 | $105,325,532 | |

Conclusion: Option 3 holds the most promise for Arizona

Table 9 (reproduced from Table 2) illustrates that compared to current policy (Option 1), Option 3 will create 21,000 new jobs compared to 15,000 new jobs with Option 2, and the state’s economy will grow by $2.8 billion instead of nearly $2 billion.

Table 9

| Economic Impact of Options 2 and 3 Compared to Option 1 (current policy) | ||

| One Year Change | Option 2:Restore Childless Adults

100% FPL Medicaid |

Option 3:Full ACA Implemented

133% FPL Medicaid |

| Added Jobs | 14,952 | 21,003 |

| Added Growth | $1.976 Billion | $2.776 Billion |

*Children 6-18 through 133 percent of FPL covered in all cases

Figures 1 and 2 illustrate these effects as well. As the state’s economic output in 2015 will be approximately $315 billion, choosing option 2 increases economic growth by 0.6 percent, while Option 3 enhances growth by 0.9 percent. Employment growth will reduce the state’s unemployment rate under Option 2 by 0.5 percent and 0.7 percent under Option 3. Hence, in terms of economic returns, Option 3 provides the most benefit to the state’s economy.

Figure 2 illustrates the cost to the state after taking into account the added tax revenues that economic growth generates. For these estimates, State and Local tax revenues are combined, so these are not net costs to the State’s General Fund, but net costs to State and Local government. Here Option 2 costs close to half a billion in 2015, and Option 3, with the assumption that the state pays 10 percent of the added coverage has a net cost of $160 million, one-third less. Thus choosing, Option 3 is also a wiser choice for the fiscal future of state and local governments compared to Option 2.

Analyzing these three scenarios, GCI finds that the most prudent choice for Arizona is Option 3, full ACA Medicaid eligibility compliance. Option 1 does cost the state less, but comes at significant losses to the state’s economic growth and employment picture, and also creates a gap population of childless adults, ineligible for Medicaid and too poor to qualify for exchange subsidies.

Option 2 provides less coverage at greater cost to the state, while providing less economic growth and job creation than Option 3, making Option 3, the clear preferred pathway for Arizona.

Dave Wells holds a doctorate in Political Economy and Public Policy and is the Research Director for the Grand Canyon Institute.

Reach the author at DWells@azgci.org or contact the Grand Canyon Institute at (602) 595-1025.

The Grand Canyon Institute, a 501(c)3 nonprofit organization, is a centrist think-thank led by a bipartisan group of former state lawmakers, economists, community leaders, and academicians. The Grand Canyon Institute serves as an independent voice reflecting a pragmatic approach to addressing economic, fiscal, budgetary and taxation issues confronting Arizona.

Grand Canyon Institute

P.O. Box 1008

Phoenix, AZ 85001-1008

GrandCanyonInstitute.org