Policy Brief

April 3, 2020

March employment report omits last three weeks, Arizona unemployment likely above 10%, projected to reach 15% by summer

Dave Wells, Ph.D., Research Director

National unemployment reached 4.4% based on a survey estimate from March 8th to 14th, rising from 3.5% in February. By now, the number will be much higher as more states have adopted stay-at-home orders.

Arizona’s February unemployment rate was 4.5%. The Arizona March update will not be released for two weeks.

The U.S. Bureau of Labor Statistics establishment survey data showed a nationwide loss of 701,000 jobs. The establishment survey — which does not include the self-employed — included the March 12th pay period, so excluded the last part of the month. Due to the survey’s lower than normal response rating, likely due to closed businesses, the number may increase once revised.

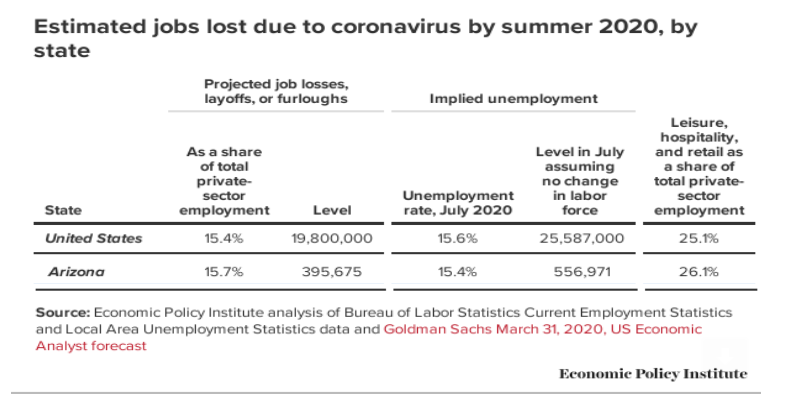

Arizona’s April jobs report will confirm the huge jump in unemployment. The Economic Policy Institute estimates by July that Arizona’s unemployment rate will hit 15.7% with 560,000 Arizonans out of work, up from 160,000 in February. The Grand Canyon Institute (GCI) estimates Arizona’s current unemployment rate has surpassed 10% based on those who have filed unemployment claims in the last two full weeks of March along with its low-end estimate for this week.

Unfortunately, the newly unemployed are unlikely to receive their first unemployment checks soon, despite suggestions that they could come as early as next week by state government officials.

States are still waiting for guidance from the US Department of Labor which has the distribution of benefits on hold while it determines guidelines for eligibility of unemployment benefits based on expanded coverage under the Coronavirus Aid, Relief, and Economic Security (CARES) Act. The Act’s Pandemic Unemployment Assistance (PUA) includes people not normally covered by state unemployment insurance including the self-employed as well as people with earnings below Arizona’s highest-in-the-nation eligibility threshold that requires them to earn $4,680 in a calendar quarter. Arizona’s eligibility threshold is more than one-third higher than the next highest state.

Wisconsin noted on its unemployment benefit site, “We are awaiting guidance from the U.S. Department of Labor (DOL). Once received, we will program our systems to accommodate the changes. It will take several weeks to receive all of the information from the Federal Government.”

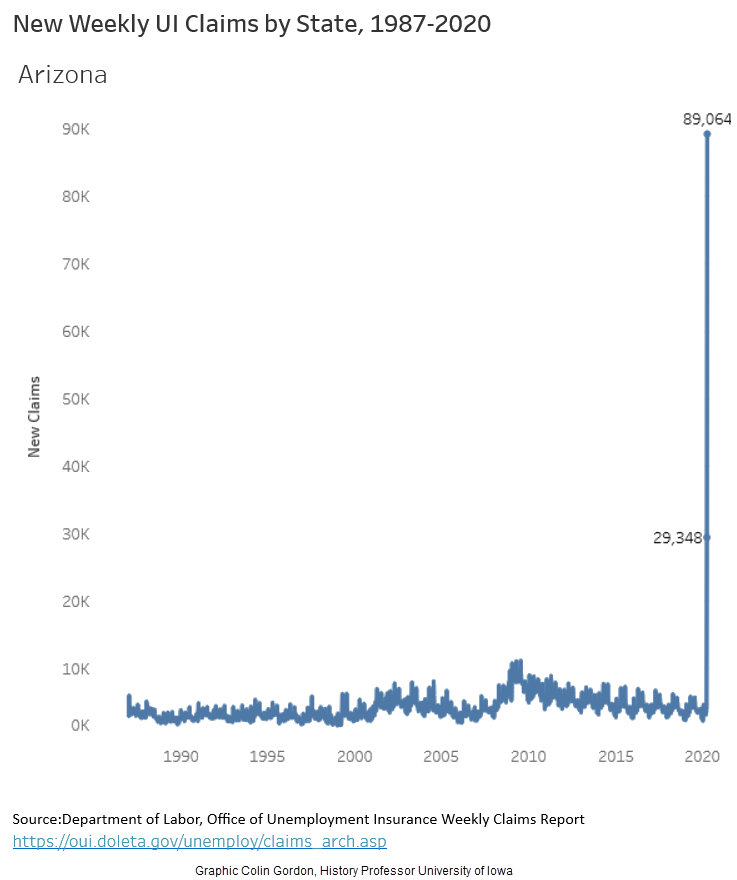

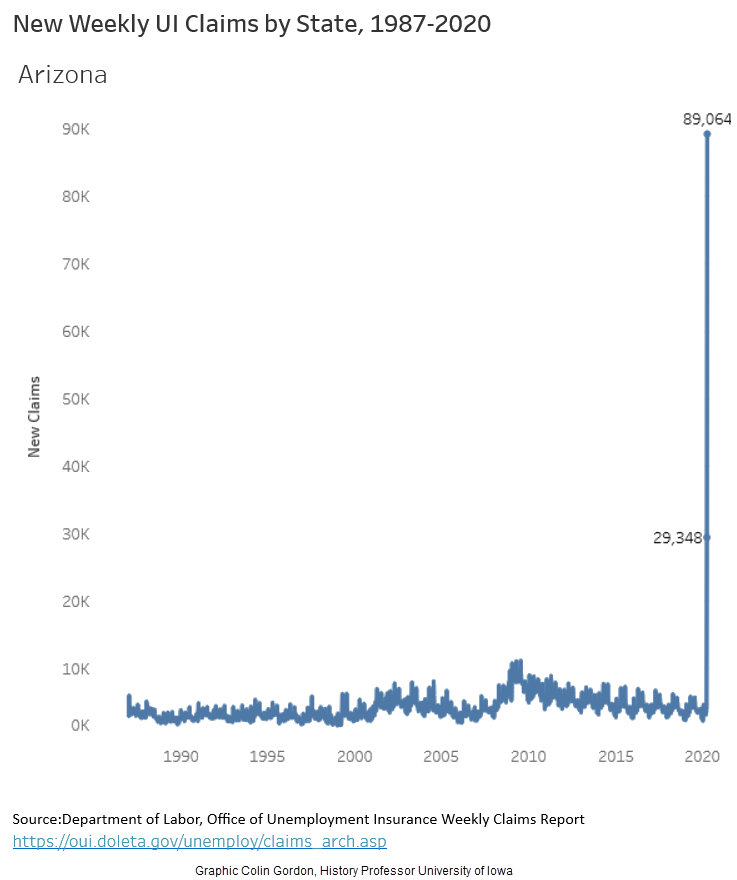

Meanwhile, the Arizona Department of Economic Security (DES) is scrambling to increase staffing as its system has been overwhelmed. Unemployment claims have skyrocketed in the last two weeks as almost 120,000 Arizonans have filed for unemployment and there are others who have been unable to file due to DES’ system being overwhelmed. Initial claims for unemployment insurance jumped from 3,844 for the week ending March 14 to 29,348 in the week ending March 21 and 89,064 in the week ending March 28. With a state-wide stay-at-home order that commenced at 5 p.m. on March 31st, GCI expects new claims to exceed 100,000 this week. These are all record amounts for Arizona, just as it is for other states.

Arizona’s DES is expanding its staffing that processes unemployment claims from 13 to more than 100 with new hires and employees redeployed from other parts of state government presently and another 22 on the way. That is a 10-fold increase in staffing while the increase in applicants has grown 30-fold.

It’s not just an issue in Arizona. For instance, in Connecticut “currently there is a five-week backlog for processing claims. In comparison, when we aren’t faced with huge numbers of claims, it typically takes less than a week to process a claim,” according to spokeswoman Nancy Steffans of the Connecticut Department of Labor. Like Arizona, Connecticut has shifted staff and added additional help.

In Arizona the normal processing time was two-weeks before the deluge. DES has said it has sent checks to about 15,000 of the 30,000 people who applied two weeks ago under pre-coronavirus guidelines, but the surge in claims will be challenging for the state to keep up with, so two-week delays could easily become four to five weeks.

And that’s just for Arizona’s regular unemployment benefits, which cap out at a miserly $240 per week, the second lowest in the nation, and about half the cap of neighboring states.

The more significant $600 weekly federal supplement under the CARES Act that runs through July has still not arrived. In addition, those qualifying under the Pandemic Unemployment Assistance benefits cannot be processed as states wait to receive federal guidance from the U.S. Department of Labor on criteria for processing.

Together that means for most of those filing for unemployment, their prospects of receiving a check for the full amount of the state benefit with the federal supplement during the month of April could be low. Many may begin to receive their state portion—which is only a fraction of the federal supplement — and in most cases replaces far less than half their prior weekly earnings.

Fortunately, Gov. Ducey issued an executive order on March 24th that should protect those who are renting from evictions.

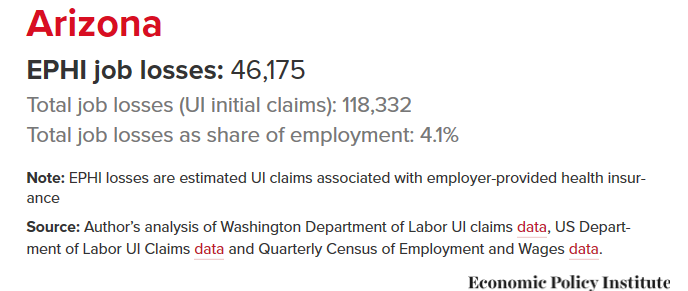

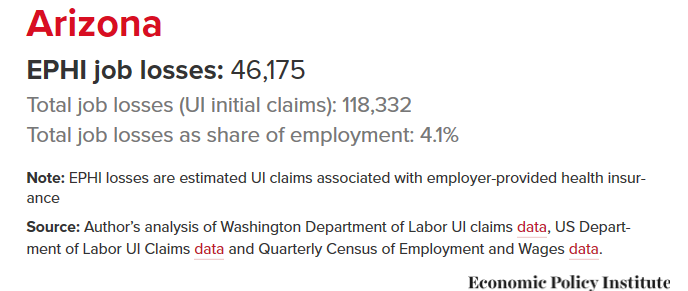

But that is not the only challenge unemployed Arizonans face. The Economic Policy Institute estimates that 46,175 Arizonans have also lost employer-provided health insurance (EPHI). Because the state chose not to operate its own ACA health insurance exchange, Gov. Ducey requested the Trump Administration re-open enrollment for health plans under the Affordable Care Act as states who operate their own exchanges have done. Unfortunately for these people, the Trump Administration turned him down on Tuesday.

Consequently, for nearly 50,000 Arizonans—COVID-19 comes with a double edge-loss of employment and potential loss of health insurance if they get sick.

GCI has developed the following resource that details benefits available to workers whose employment is impacted by COVID-19.

GCI is also raising the issue that Arizona’s unemployment benefits are the worst in the United States and should be reformed for those who continue to be impacted by a recession once federal supplemental benefits end in July.

Dave Wells holds a doctorate in Political Economy and Public Policy and is the Research Director for the Grand Canyon Institute, a centrist fiscal policy think tank founded in 2011. He can be reached at DWells@azgci.org or contact the Grand Canyon Institute at (602) 595-1025.

The Grand Canyon Institute, a 501(c) 3 nonprofit organization, is a centrist think tank led by a bipartisan group of former state lawmakers, economists, community leaders and academicians. The Grand Canyon Institute serves as an independent voice reflecting a pragmatic approach to addressing economic, fiscal, budgetary and taxation issues confronting Arizona.

Grand Canyon Institute

P.O. Box 1008

Phoenix, Arizona 85001-1008

GrandCanyonInsitute.org

Policy Brief

Policy Brief