Policy Paper

October 18, 2018

Threatened by Prop 126: Mesa Police & Fire, Tempe Arts, Flagstaff and Scottsdale Road &Transportation November Tax Measures

Dave Wells, Ph.D., Research Director

Max Goshert, Sr. Research Associate

Executive Summary

Proposition 126 (Prop. 126), a constitutional amendment on November’s ballot, forbids state and local governments from creating new taxes or higher tax rates on services that were not already taxed as of December 31, 2017. Currently, Arizona exempts most services from taxation, but also taxes many services such as hotel stays, restaurants and bars.

Prop. 126 would impact any tax that is reauthorized, with one tax expiring replaced by a new version of the tax. The new version of the tax would be subject to the restrictions of Prop. 126. The education sales tax reauthorization is a good illustration. As noted by Michael Braun of the Arizona Legislative Council in a story in the Arizona Republic, “The existing (tax) is going to expire and the new one … will start after the expiration of the existing one — just a second or two, but still,” Braun said … “One expires, the next one kicks in…. Because that is a new tax, that requires Prop. 108.”[1]

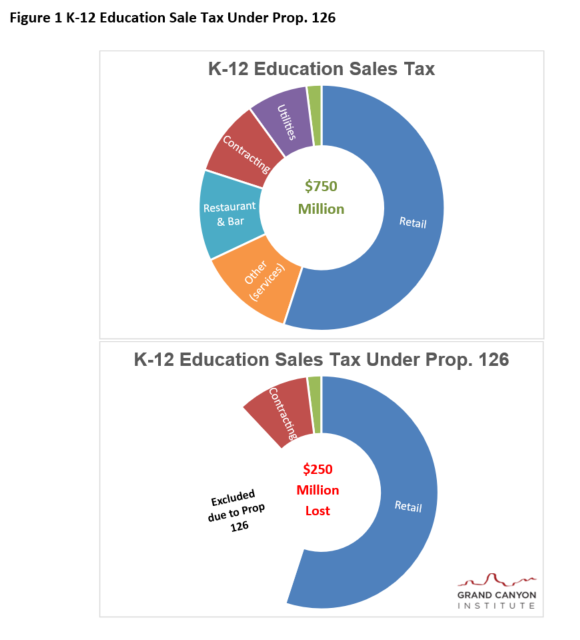

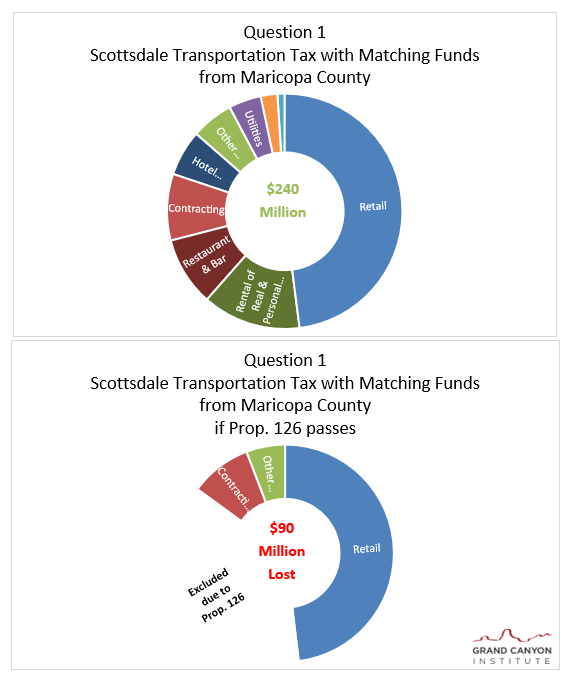

Last week the Grand Canyon Institute estimated that the education sales tax renewal will lose one-third of revenues if Prop. 126 passes, which would currently amount to $250 million annually (See Figure 1).

The impact will also hit cities—both when the reauthorize expiring sales tax measures and especially when they seek to renew such measures. On the November ballot, four Arizona cities are seeking voter approval and all four will lose significant revenue if Prop. 126 passes.

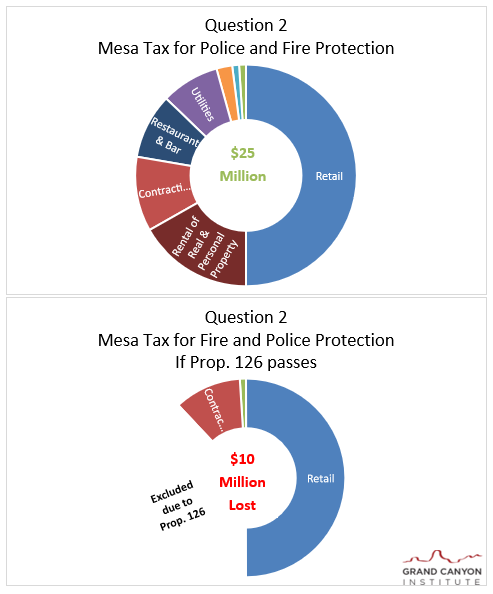

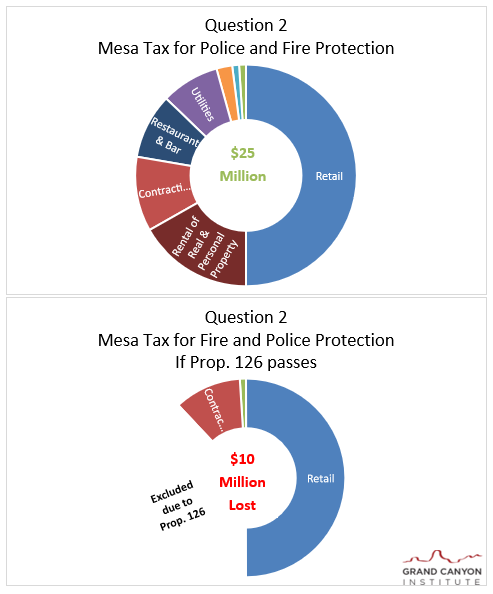

Mesa Question 2 is requesting to increase its sales tax by 0.25 percent to raise $25 million annually for police and fire, including hiring 65 more police and 45 firefighters. If Prop. 126 passes, this new tax would lose $10 million in revenue as its service portion is exempted, leaving only $15 million from Question 2 for Police and Fire.

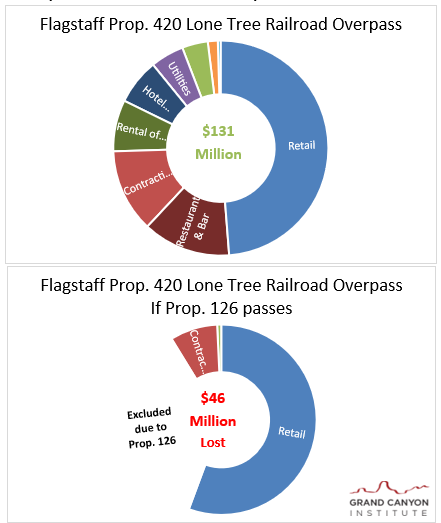

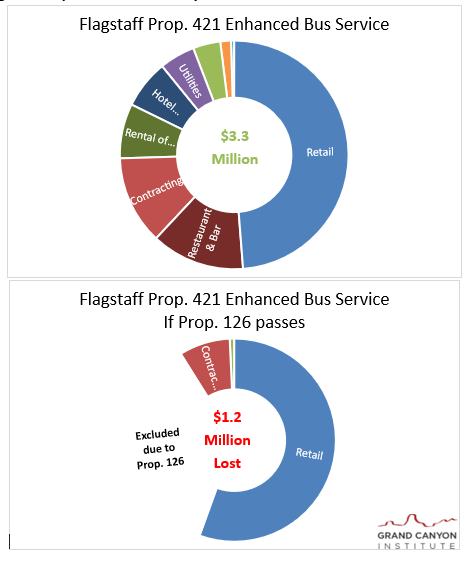

Flagstaff is seeking renewal of two transportation levies and an increase with a third with Prop. 419, 420 and 421 on its ballot. While Prop. 419 to continue an existing transportation tax should be fine, two new levies for transportation and bus service would lose 35 percent of their anticipated revenue.

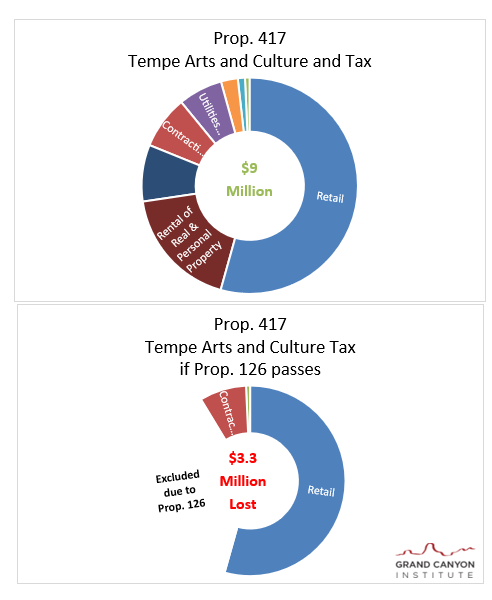

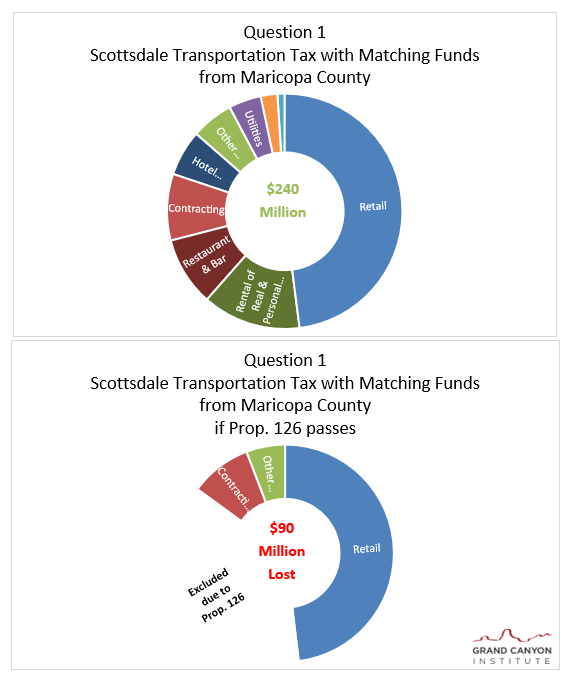

Scottsdale, too, is seeking a rise in its transportation sales tax to fund road improvement projects that are eligible for matching funds from Maricopa county. There every dollar taken by Prop. 126 will be doubled. Scottsdale over 10 years aims to raise $71 million to leverage an additional $170 million from the county. But if Prop. 126 passes, Scottsdale will have $90 million less, losing precious matching funds from the county.

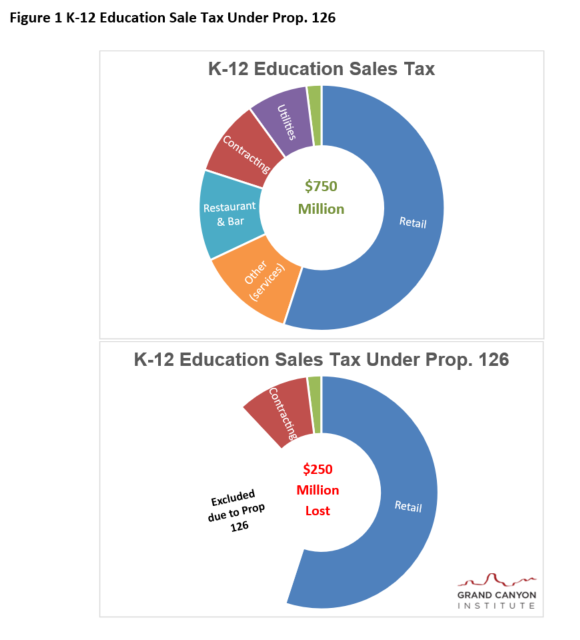

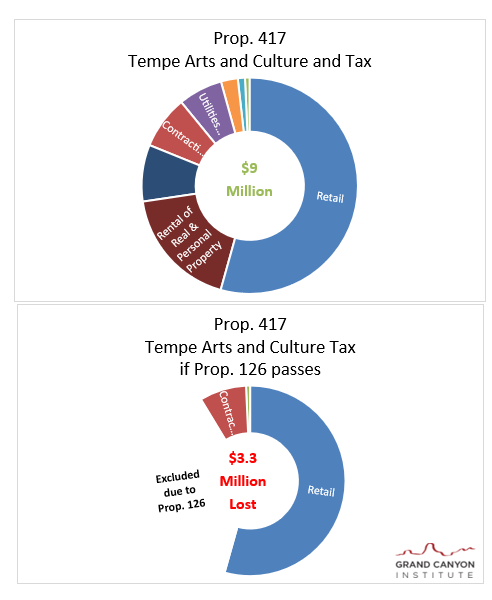

Tempe is seeking to renew its quarter percent Art and Culture Tax. The tax brings in about $9 million a year,but will lose more than $3 million if Prop. 126 passes and Tempe voters approve Prop. 417.

As can be seen here, when policymakers wish to change tax policy in the state, they go to voters. There’s no need to place a prohibition on taxing services in the state’s constitution.

It is for these reasons that both major party Gubernatorial candidates Republican Governor Doug Ducey and Democratic challenger David Garcia oppose Prop. 126.[2]

Background of Proposition 126

Proposition 126 amends the Arizona Constitution to restrict the state and municipal governments from imposing any tax on services which was not already in place as of December 31st, 2017.[3] The group which collected 406,000 signatures surpassing the 225,963 needed to get on the ballot is a political action committee (PAC) called the Citizens for Fair Tax Policy.[4] Currently, Arizona only taxes a limited number of services (60 as of 2007).[5] Most services, such as barber shops, fitness centers, and advertising, are not subject to the Transaction Privilege Tax (TPT).[6] The full Federation of Tax Administrators survey results for services taxed across the 50 states is in the appendix.

Prop 126 has been supported almost entirely by realtors. Citizens for Fair Tax Policy has collected $5.1 million from Arizona realtors through the Realtors Issues Mobilization Fund and another $1 million from the National Association of Realtors.[7] Out of 18 arguments for the measure that were published in the voter’s pamphlet distributed by the Arizona Secretary of State, twelve were written by realtors (only one of whom disclosed their profession). The argument that these groups make is that taxes on services will harm small business and low-income taxpayers.

While the vast majority of support comes from realtors, those opposed to the measure represent conservative, centrist, and liberal viewpoints. Opposition to Prop 126 includes the conservative Americans for Prosperity, the centrist Grand Canyon Institute (GCI) and Arizona League of Cities and Towns, and the liberal Arizona Center for Economic Progress and the affiliated Children’s Action Alliance. These groups make different forms of a similar argument, that the amount of goods consumed as a proportion of total consumption is declining, while service consumption is on the rise. The current TPT, which primarily taxes goods, is inequitable, because businesses who sell exempt services are not subject to the same treatment as those who sell goods. Buy clothes for your children and pay a tax. Get a manicure and a massage, no tax. In addition, all share the concern that Prop. 126, if passed, would cut education and transportation funding.

Prop. 126 Cuts K-12 Education $250 million annually

The current TPT (sales tax) primarily focuses on the goods sector. However, a significant portion already taxes services or areas that could be arguably put forward as services with the Arizona courts being forced to adjudicate. Current statute defines what is taxed but doesn’t use a goods and services demarcation. Prop. 126 as a Constitutional amendment has the potential to overturn any area in statute that could arguably put forward as a service. However, Prop. 126 does not define service. So for purposes of our analysis we use Bureau of Economic Analysis (BEA) categorization to differentiate goods from services. All of these areas that fall under services would have the tax rescinded when any tax came up for renewal or whose rate was increased. [8] Likewise, any municipality or locality that wished to add a small increment to their local sales tax would find that any areas that fall under services would be exempt from the tax. The consequence, is that tax renewals and new sales taxes would provide significantly less revenue than under current statute, between 33 and 40 percent less.[9]

Table 1 Goods and Services subject to current Sales (TPT) Taxation

The BEA classifications are listed in Table 1 along with corresponding areas currently taxed that would fall under each area. A wide range of services currently are taxed.

While Prop. 126 exempts services that are taxed as of December 31, 2017 at that level of taxation, it does not take into account when taxes expire and need to be reauthorized. For instance, SB1390 reauthorized the Education 0.6 percent sales tax from 2021 to 2041 because the original Prop. 301 authorization expires. Below is the language from the legislation:

From and after June 30, 2021 through June 30, 2041, in addition to the rate prescribed by subsection C of this section, an additional rate increment of six‑tenths of one percent is imposed and shall be collected. The taxpayer shall pay taxes pursuant to this subsection at the same time and in the same manner as under subsection C of this section. [10]

“From and after June 30,2021 …An additional rate increment” would be interpreted as a new tax by the language of Prop. 126. This is why a two-thirds vote was needed to renew it under Prop. 108. Consequently, the areas to be taxed under the renewal of the education sales tax would need to exclude any services in Table 1.

While this impact would not occur until July 2021, for purposes of comparison we use projected FY2019 revenues with and without Prop 126 to estimate the likely loss of revenue in current dollars. For the education tax extension one-third of revenues would be lost based on the TPT revenue breakdown reported in the JLBC 2018 Tax Handbook noted in Table 2. The handbook reports 15 percent of revenues as “other,” with no demarcation by category. Other (goods) include publication and job printing including photocopying as well as the tax on mineral mining (coal) and a value added (severance) tax on metallic mining such as copper. The other (service) category includes transient lodging (e.g., hotels), amusements (e.g., sporting events, movies), and rental of personal property (e.g., rental and leased vehicles). Data on the service side suggests that for the state transient lodging accounts for 2.4 percent. Data from Pima and Maricopa County implies rental of personal property may be 8 to 12 percent.[11] Pima data suggests communications could be an additional 2 percent. On the goods side, data for the state shows mining metals and minerals generate about 1 percent. Collectively these total around 15 percent and is not inclusive of all subcategories. GCI estimates 13 percent of other is services and the remaining 2 percent is goods. This means services encompass 33 percent or one-third of revenues for statewide sales taxes. When this 33 percent exclusion is applied, prospective Education sales tax revenues decrease $250 million annually.[12]

Table 2 Education Sales Tax Revenue Breakdown

| Category |

Portion of Revenues |

Impact of Prop. 126 |

| Retail |

55% |

Allowed |

| Contracting |

10% |

Allowed |

| Other (goods) |

2% |

Allowed |

| Utilities |

8% |

Prohibited |

| Restaurant & Bar |

12% |

Prohibited |

| Other (services) |

13% |

Prohibited |

Source: JLBC, 2018 Tax Handbook with other breakdown estimate from GCI.

Likewise, any future effort to use sales taxes to expand education funding further as had been advocated by some business leaders in the last year would face the same restriction. These leaders had advocated that the education sales tax should be increased from 0.6 percent to 1.5 percent to raise a billion dollars. Under Prop. 126, the rate would need to be 2 percent in order to generate the same amount of revenue. Figure 1 illustrates how the education sales tax or any state sales tax would be impacted by Prop. 126.

Figure 1 K-12 Education Sale Tax Under Prop. 126

Police, Fire, Transportation and the Arts Lose under Prop. 126

Table 3 Mesa, Flagstaff, Scottsdale and Tempe Sales Tax Breakdown

|

Mesa |

Flagstaff |

Scottsdale |

Tempe |

Under Prop. 126 |

| Retail |

50% |

49% |

48% |

54% |

included |

| Contracting |

11% |

13% |

9% |

8% |

included |

| Other (goods)[13] |

1% |

4% |

6% |

1% |

included |

| Utilities |

9% |

5% |

4% |

7% |

prohibited |

| Amusements |

1% |

0.5% |

1% |

1% |

prohibited |

| Communications |

2% |

2% |

2% |

In utilities |

prohibited |

| Hotel/Motel |

Separate tax |

7% |

6% |

3% |

prohibited |

| Restaurant & Bar |

10% |

13% |

9% |

8% |

prohibited |

| Rental of Real and Personal Property |

17% |

8% |

14% |

18% |

prohibited |

Source: Mesa: “Tax Revenue Summary Consumer Activity March 2018,” https://www.mesaaz.gov/home/showdocument?id=4498, Flagstaff: “Flagstaff Tax and Fee Revenues-June 2018” https://www.flagstaff.az.gov/DocumentCenter/View/58777/-JUNE–2018- Scottsdale: “Comprehensive Annual Financial Report for the Fiscal Year ended June 30, 2017” https://www.scottsdaleaz.gov/Assets/ScottsdaleAZ/Finance/CAFR/CAFR+2017.pdf. Tempe: “Tax Revenue Statistical Report-June 2018,” https://www.tempe.gov/home/showdocument?id=69425.

Mesa Loses $10 million a year for police and fire

Mesa leaders are concerned they are understaffed, so have put Question 2 on the November ballot to raise a quarter cent sales tax to raise $25 million annually for police and fire.[14] If Prop. 126, passes, Mesa stands to lose $10 million that would come from services under this new tax. Thirty-eight percent of sales tax revenue in Mesa comes from services.

Figure 2 Mesa Question 2 Police and Fire Sales Tax

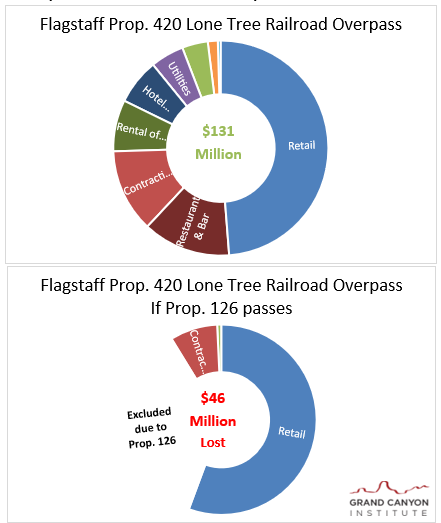

Flagstaff has overpass project undermined and bus service hindered

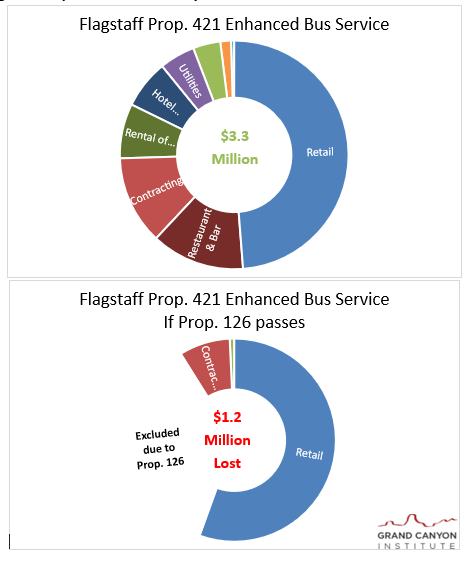

Flagstaff has Propositions 419, 420 and 421. Prop. 419 renews an existing 0.426 percent transportation tax. Because the language of Prop. 419 is quite explicit that it is continuing an existing tax, as opposed to the Prop. 301 renewal which more clearly fits the standard of a new tax at the same rate, GCI does not think that Prop 419 will be impacted by Prop. 126. However, Prop. 420 and 421 are additional sales taxes that clearly fall under the purvey of Prop. 126. Prop. 420 is a 0.23 percent 20-year tax to fund the Lone Tree Railroad Overpass by enabling the City of Flagstaff to issue bonds and pay them off. The city expects over the 20 year period this measure will raise $131 million. However, if Prop. 126 passes, the city would lose 35 percent of revenue due sales taxes on services, meaning the measure would provide $46 million less in revenue. Prop. 126 would needlessly complicate this project, if Flagstaff voters approve the measure. Prop. 421is a measure to enhance bus service within Flagstaff and builds on prior measures that have also funded bus service. However, it is a new tax by raising the sales tax rate by 0.15 percent. Prop. 126 would undercut its objectives by removing 35 percent of its funding, so Prop. 421 would raise $2.1 million instead of $3.3 million—significantly diminishing the ability of the city to enhance bus service.[15]

Figure 3 Flagstaff Prop. 420 Lone Tree Railroad Overpass

Figure 4 Flagstaff Prop. 421 Enhanced City Bus Service

Scottsdale loses a huge sum in matching funds for them county

Scottsdale’s Question 1 would raise the city’s sales tax by 0.1 percent for 22 identified transportation projects. It is expected to raise the city’s share of a match to leverage additional funds from Maricopa County. By raising $71 million, Scottsdale would receive an additional $170 million, so the match is more than a 2 to 1 gain for the city.[16] Unfortunately, as a new tax, Scottsdale would lose 37 percent of anticipated revenue if Prop. 126 passes along with Question 1, meaning instead of about $240 million, Scottsdale would receive about $150 million, $90 million less.

Figure 5 Scottsdale Question 1 Transportation Sales Tax with County Match

Tempe’s Art and Culture Tax Threatened

Tempe voters in 2000 approved a 0.1 percent sales tax dedicated to Art and Culture and it was focused on building and supporting the Tempe Center for the Arts. Now the council is asking voters to make the tax permanent as it expires in 2020. The language of Prop. 417 though is different from Flagstaff’s Prop. 419. While Flagstaff’s language is clear it’s continuing a tax, Tempe’s Prop. 417 refers to it as a “new tax.”

Prop. 417: The City of Tempe’s existing arts tax of one-tenth of one percent terminates December 31, 2020. Effective January 1, 2021, shall a new one-tenth of one percent transaction privilege tax and use tax, from 1.7 to 1.8 percent, be levied to fund arts and culture throughout Tempe?[17]

Figure 6 Tempe Prop. 417 Art and Culture Tax

Consequently, if Prop. 126 passes and Tempe voters approve Prop. 417, Arts and Culture will be shortchanged 37 percent or more than $3 million per year of the $9 million the tax would otherwise raise annually.

Conclusion

Prop. 126 creates an unnecessary constitutional obstacle to investing in education at the state level and for cities to produce enough revenue for measures their voters pass. In 1992, Arizona voters passed Proposition 108 (Prop 108) which added a provision to the state constitution that required a 2/3 vote by the House and Senate for any bill which attempted to impose new taxes or increase existing taxes.[18] Because of this law, most tax increases now occur through ballot measures, either by the public via citizens initiatives or by the Legislature through ballot referrals (which is not subject to the same restrictions). As can be seen here, cities also seek voter approval for any tax change. The only sales tax increase that has occurred since Prop 108 was passed was the reauthorization of the education tax from Prop. 301, which was passed via a ballot initiative and extended by a 2/3 vote in the Legislature in March. [19]

That Prop. 108 applied to this reauthorization indicates it is a new tax and thus subject to Prop. 126, if it passes. GCI estimates that if Prop 126 is approved that the dedicated education tax will have one-third less revenues or $250 million less dollars annually once the renewal begins in Fiscal Year 2022.

Likewise, cities as they seek to retain expiring taxes or add taxes to fund desired city services, whether police, fire, transportation or the arts, will find Prop. 126 removes significant areas of taxation and likely lead to further escalation over sales taxes on goods or voter pushback over excessively high tax rates on goods.

Both Republican Doug Ducey and Democrat David Garcia reject Prop. 126, so should voters on November 6th.

Dave Wells holds a doctorate in Political Economy and Public Policy and is the Research Director for the Grand Canyon Institute, a centrist fiscal policy think tank founded in 2011. He can be reached at DWells@azgci.org or contact the Grand Canyon Institute at (602) 595-1025, ext. 2.

Max Goshert is completing his masters degree in Public Policy at Arizona State University. He can be reached at MGoshert@azgci.org.

The Grand Canyon Institute, a 501(c) 3 nonprofit organization, is a centrist think tank led by a bipartisan group of former state lawmakers, economists, community leaders and academicians. The Grand Canyon Institute serves as an independent voice reflecting a pragmatic approach to addressing economic, fiscal, budgetary and taxation issues confronting Arizona.

Grand Canyon Institute

P.O. Box 1008

Phoenix, Arizona 85001-1008

GrandCanyonInstitute.org

[1] Sanchez, Yvonne Wingett (2018), “Doug Ducey to sign tax measure—is he violating his pledge to never raise taxes?” Arizona Republic, March 22, https://www.azcentral.com/story/news/politics/legislature/2018/03/22/pressure-mounting-doug-ducey-break-his-pledge-never-raise-taxes/448003002/. Prop. 108 requred two-thirds approval in both chambers to implement a new tax.

[2] Fischer, Howard (2018), “Arizona’s Prop. 126-a ban on taxing services-draws a diverse resistance,” Arizona Daily Star, Oct 1, https://tucson.com/news/local/arizona-s-prop-a-ban-on-taxing-services-draws-diverse/article_b133e82e-2887-5415-b08f-85f39ad7d657.html

[3] The Protect Arizona Taxpayers Act: Ballot measure, Arizona. (2018). Retrieved from https://protectaztaxpayers.com/wp-content/uploads/2018/07/Ballot_Initiative_Text.pdf.

[4] @SecretaryReagan. (2018, July 3). The 1st of the ballot measure committees (Citizens for Fair Tax Policy) has filed signatures. They’ve reported 406K signatures. We have 20 biz days to process the petitions then counties have 15 to verify a sample of the signatures. http://www.Arizona.Vote for more information [Tweet]. Retrieved from https://twitter.com/SecretaryReagan/status/1014235169140510720.

[5] Federation of Tax Administrators. (2017, July-August). FTA survey of services taxation – update. Retrieved from https://www.taxadmin.org/btn-0817_services. Arizona did not participate in the 2017 survey update, so the data from Arizona is from 2007.

[6] Fischer, H. (2018, March 12). Realtors seek ballot measure to ban taxation of services. Arizona Capitol Times. Retrieved from https://azcapitoltimes.com/news/2018/03/12/realtors-seek-ballot-measure-to-ban-taxation-of-services/. Advertising is taxed by most cities, however.

[7] Randazzo, R. (2018, September 13). Prop. 126 tax-measure ads are all over Phoenix airwaves – here’s who is behind them. AZ Central. Retrieved from https://www.azcentral.com/story/news/politics/elections/2018/09/13/arizona-proposition-126-ballot-measure-backed-real-estate-interests/1194565002/.

[8] Arizona Dept. of Revenue, “Arizona State, City and County Transaction Privilege and Other Tax Rate Tables,” Effective Oct. 1, 2018, https://azdor.gov/sites/default/files/media/TPT_RATETABLE_10012018.pdf.

[9] Calculations in this paper range from 33 to 37 percent, but because cities typically also tax the service areas of advertising and residential rental units, their portion of service is higher.

[10] Fifty-third Legislature, Second Regular Session, 2018, Chapter 74, Senate Bill 1390, https://www.azleg.gov/legtext/53leg/2R/laws/0074.htm.

[11] Rental of Personal Property from Arizona Dept. of Transportation, “Maricopa County Excise Tax: FY2017 Actual Revenue Distribution Flow;” https://azdot.gov/docs/default-source/businesslibraries/rarftankchart_17.pdf?sfvrsn=4; Hammond, George and Alberta Charney (2017), “A Revenue Forecasting Model for the Pima RTA: updated to 2016,” Economic and Business Research Center, Eller College of Management, University of Arizona, March, http://www.rtamobility.com/documents/pdfs/RTATMC/2017/RTATMC-2017-08-28-Item-3D-FinalReportRTA-2017-3-28.pdf.

[12] Assumptions made. FY2019 projection based on 5% real growth over FY2018. Mining data is from Ginsberg, Robert (2008), “Mining Taxes in Ten Western States,” Center on Work and Community Development, April, http://equalitystate.org/assets/pdfs/reports/Western_mining_and_taxes_report.pdf. Transient lodging data from Hazinski, Thoasm et al. (2016), “2016 HVS Lodging Tax Report-USA,” HVS, August https://www.hotelnewsresource.com/pdf16/HVS082916.pdf. Rental of Personal Property from Arizona Dept. of Transportation, “Maricopa County Excise Tax: FY2017 Actual Revenue Distribution Flow,” https://azdot.gov/docs/default-source/businesslibraries/rarftankchart_17.pdf?sfvrsn=4. Data from sources adjusted at times for portion going to the state, e.g., mining was adjusted for state shared revenue.

[13] Other was assumed to be only goods. Where separate or additional taxes are levied on hotel and motels they were excluded. Mesa’s amusements and communication percentages were applied to Scottsdale and taken from its other category since Scottsdale did not pull them out.

[14] Altavena, Lily (2018), “Mesa to vote on public safety tax hike, 1st of several money requests that may hit ballot,” Arizona Republic, May 9, https://www.azcentral.com/story/news/local/mesa/2018/05/09/mesa-ask-voters-increase-sales-tax-fund-police-fire-school-district/588470002/

[15] Information Pamphlet for the City of Flagstaff, Arizona General/Special Election November 6, 2018 compiled and issued by the City of Flagstaff, Arizona, https://www.flagstaff.az.gov/DocumentCenter/View/58870/PP2018FINALENGLISH.

[16] “Yes for Scottsdale Streets Launches to Support Infrastructure Ballot Measure,” Scottsdale Independent, July 18, 2018, https://www.scottsdaleindependent.com/news/yes-for-scottsdale-streets-launches-to-support-infrastructure-ballot-measure/

[17] Tempe Arts & Culture, Tomorrow is you last day to register to vote before the election, post date September 28, 2018, City of Tempe, https://www.tempe.gov/Home/Components/News/News/13052/873

[18] Hoffman, J. (2011). Prop 108: Putting the brakes on state tax increases. League of Arizona Cities and Towns. Retrieved from http://www.leagueaz.org/connection/2011/0711/index.cfm?a=prop108.

[19] Cano, R. (2018, March 22). Arizona Legislature passes education sales tax plan. AZ Central. Retrieved from https://www.azcentral.com/story/news/politics/arizona-education/2018/03/22/arizona-lawmakers-fast-track-proposition-301-education-sales-tax-extension/447963002/.

Research

Research