Blog

Blog

Private School Subsidies: A very expensive gift that may also be unconstitutional

January 22, 2020Private School Subsidies:

A very expensive gift that may also be unconstitutional

Summary

• The US Supreme Court will consider a case that addresses the use of tax credits to pay for private school tuition at a religious school.

• Arizona’s private schools are mostly religious and not bound by curricular standards and can discriminate against students or families who do not comply with the tenets of the school’s religion.

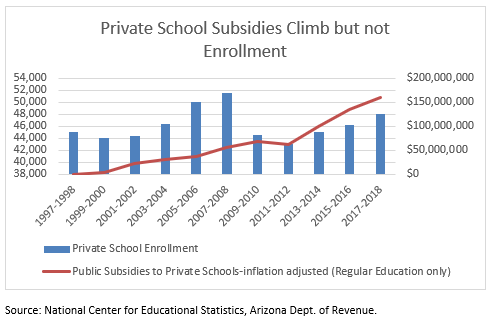

• Arizona redirects about $200 million per year on private school subsidies.

• Arizona’s private school subsidies have increased student enrollment by only 4,000 over 20 years.

• Charter schools are a much more successful and less expensive school choice option, serving 160,000 more students annually than they served 20 years ago.

Introduction

Today the U.S. Supreme Court will hear the case Espinoza v. the Montana Dept. of Revenue. As in Arizona, Montana has created a way to divert state revenue to private, typically religious, schools via tax credits for individuals that fund scholarships. Created in 2015, the Montana program is puny compared to Arizona’s, offering a $150 tax credit to taxpayers with scholarships of $500 dispersed to students.

Most private schools are religious. Private schools are not bound by any curricular standards. Therefore, they can teach creationism including science based on its tenets, that homosexuality is a sin, and not admit children who do not meet the beliefs of their religion—such as having two lesbian parents. The U.S. Supreme Court will be evaluating whether Montana’s private school tax credit program represents a government establishment of religion. The decision may disrupt the system of private school subsidies in Arizona.

Private school subsidies in Arizona

In Arizona, the only curricular requirements for private schools are, “Every child between the ages of six and sixteen years shall attend a school and shall be provided instruction in at least the subjects of reading, grammar, mathematics, social studies and science. The person who has custody of the child shall choose a public, private, charter or home school as defined in this section to provide instruction.” Ariz. Rev. Stat. Ann. §15-802A.

Like Montana’s private school tax credit program, Arizona’s two private school subsidy programs were designed to avoid Arizona’s Constitutional prohibitions.

No public money or property may be appropriated or applied to any religious instruction or in support of any religious establishment. Arizona Constitution, Art. 2, Sec. 12. The state school fund may be apportioned only for public education. Arizona Constitution, Art. 11, Sec. 8.

In addition, Arizona also has a “gifts clause” that restricts gifts or subsidies to private entities—irrespective of being religious or secular.

Neither the state, nor any county, city, town, municipality, or other subdivision of the state shall ever give or loan its credit in the aid of, or make any donation or grant, by subsidy or otherwise, to any individual, association, or corporation, or become a subscriber to, or a shareholder in, any company or corporation, or become a joint owner with any person, company, or corporation, except as to such ownerships as may accrue to the state by operation or provision of law or as authorized by law solely for investment of the monies in the various funds of the state. Arizona Constitution, Art. 9, Section 7.

Since 1998, Arizona individuals and corporations have been able to divert tax dollars to student tuition organizations that grant private school scholarships. In 2011, the state began the direct appropriation of taxpayer dollars through Empowerment Scholarship Accounts, essentially private school vouchers paid directly to parents who then pay it to private schools. That sleight of hand has enabled it to survive challenges based on the Arizona Constitution—but most of the money ends up supporting religious-based education.

In sharp contrast to Montana, Arizona’s program has been in existence for 20 years. It allows dollar-for-dollar tax credits of up to approximately $1,000 for individuals and $2,000 for married couples—and a minimum of $5,000 in tax credits for corporations—including S corporations where the corporate income is a pass through that is reported on an individual’s tax return. S Corporations using the credit has exploded since the Federal government passed the Tax Cuts and Jobs Act in December 2017.

Private school enrollment in Arizona

Arizona does not have a system to track how many scholarships students receive. Education Secretary Betsy DeVos in an Arizona Republic editorial in December mistakenly claimed, “Last year, nearly 100,000 students were estimated to have enrolled in Arizona’s three tax-credit scholarship programs.” Secretary DeVos’ own U.S. Dept. of Education’s census of private school enrollment found less than 50,000 private school students enrolled in Arizona. Secretary DeVos counted scholarships awarded, not recipients—and clearly many students are receiving multiple scholarships.

Research shows that academic outcomes from private school vouchers are disappointing

The state has never evaluated the quality of the education received at private schools, but the Fordham Institute, a pro-school choice think tank evaluated Ohio’s private school voucher program and its researchers noted:

The students who use vouchers to attend private schools have fared worse academically compared to their closely matched peers attending public schools. The study finds negative effects that are greater in math than in English language arts. Such impacts also appear to persist over time, suggesting that the results are not driven simply by the setbacks that typically accompany any change of school (p. 2).

Private school subsidies ineffective at increasing school choice

In addition to possibly having negative academic impacts, Arizona’s private school subsidy programs are expensive and ineffective. When the private school tax credit program began twenty years ago, about 44,000 students were already attending private schools. In the most recent census that number was 48,000. So over 20 years, we’ve seen the number of students attending private schools increase by 4,000. In sharp contrast when the program began there were also about 44,000 students attending charters schools, and that has increased to 200,000. Clearly one school choice program is attracting students much better than the other. Charter schools, unlike private schools, do have to meet curricular standards and do the full range of testing required by the state. They cannot discriminate as a basis for enrollment.

However, there’s a key difference when it comes to funding. Charter schools are funded based on their average daily membership with all the dollars coming from the state’s general fund. Private schools are indirectly funded by Empowerment Savings Account vouchers and school tuition organization (STO) tax credit scholarship donations that give taxpayers dollar for dollar tax credits in return. The STO tax subsidies are not tied to enrollment. So the tax subsidies can rise, even if enrollment does not. In fact, that is what has occurred.

$10,700 per student and possibly rising

Twenty years ago, private schools used to operate financially independent of the state and enrolled 44,000 students. In FY2017, diverted tax dollars that went to scholarships totaled $150 million — that excludes the $45 million for ESA vouchers — so collectively, the cost was about $200 million. It’s not $200 million for 4,000 more students—or $50,000 a student. Why not? Because charter schools are a substitute for private schools. If the state had not added private school subsidies, GCI using regression analysis estimates that private school enrollment would have declined with families opting for charter schools instead. GCI, focusing only on the amount of funds directed to regular education private school students (so excluding special education), estimated that it cost the state $10,700 per student who attended private school due to the scholarship in FY2016. GCI is still awaiting Arizona Dept. of Revenue’s FY2018 data, but its preliminary analysis suggests that cost will remain the same or increase, which is more than 50 percent higher than what the state funds charter school students. The private school tax subsidies are very expensive programs that primarily benefits religious schools with no academic accountability.

The graph below shows only the tax dollars adjusted for inflation to private schools benefiting regular education students. The $160 million for FY2018 is an estimate based on $154 million in FY2017. The private school numbers come from a census of private school enrollment conducted by the U.S. Dept. of Education every other year.

Espinoza and Arizona

If the Supreme Court rules that the Montana program is unconstitutional, private religious schools in Arizona will lose their state subsidies sourced from private school scholarships. If it permits the Montana program, then the status quo will remain in Arizona. At which point, the question for Arizona lawmakers will be whether to take issue with the cost of the state’s private school subsidies. If they refuse, then voters should demand that they at least raise per student funding levels to a comparable amount for district and charter schools. Most public schools would relish $10,700 per student.

Dave Wells, Ph.D., Research Director, dwells@azgci.org, (602) 595-1025, ext. 2

The Grand Canyon Institute, a 501(c) 3 nonprofit organization, is a centrist think tank led by a bipartisan group of former state lawmakers, economists, community leaders and academicians. The Grand Canyon Institute serves as an independent voice reflecting a pragmatic approach to addressing economic, fiscal, budgetary and taxation issues confronting Arizona.

Grand Canyon Institute

P.O. Box 1008

Phoenix, Arizona 85001-1008

GrandCanyonInsitute.org