Blog

Blog

Supreme Court Rewards Rich with Porsches Everyone else gets Pizza

April 22, 2022Supreme Court Rewards Rich with Porsches

Everyone else gets Pizza

Yesterday, the Arizona Supreme Court denied Arizona voters the right to use the referendum process to vote on permanent tax policy that profoundly limits the state’s ability to create economic prosperity for all its residents.

Citing this clause in the Arizona Constitution:

Referendum power; emergency measures; effective date of acts. The second of these reserved powers is the referendum. Under this power the legislature, or five per centum of the qualified electors, may order the submission to the people at the polls of any measure, or item, section, or part of any measure, enacted by the legislature, except laws immediately necessary for the preservation of the public peace, health, or safety, or for the support and maintenance of the departments of the state government and state institutions…

In this case, the Supreme Court decided that Arizona voters may not refer to the ballot a massive tax cut for the wealthy–even though it imperils future funding of “public peace, health, or safety, or for the support and maintenance of the departments of the state government and state institutions.” While this massive gift to the wealthy was enacted by a bare majority of the legislature, undoing this damage will now take a ⅔ vote of the legislature to rebalance the tax responsibilities of Arizona’s wealthiest income earners.

Reasonable people would understand the intent in the Constitution is to ensure that annual state government budget appropriations are not subject to referendum. Citizens cannot refer K-12 education appropriations to the ballot, for example. However, preventing voters from expressing their views on permanent tax policy is clearly not intended by the clause. Especially a massive tax cut that in an economic recession will likely undermine the preservation of “public peace, health, or safety, or for the support and maintenance of the departments of the state government and state institutions.”

For those still unsure, the Arizona Constitution’s referendum power was a product of the progressive era which sought to counter the power of the financially privileged.

Given the Arizona Supreme Court’s logic with this ruling, the legislature can now bankrupt the state and citizens have no recourse–and that might be what transpires in the years ahead.

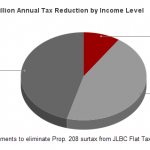

In its analysis of the state government’s 2.5% flat tax passed in 2021, the Grand Canyon Institute (GCI) found that Arizona’s wealthiest (top 0.03% of tax filers) will see tax cuts of $206 million while half of the state’s tax filers will save a total of $15 million.

The 2.5% flat income tax rate will provide these wealthiest Arizonans with enough money to buy a new Porsche 911 every year – while nearly everyone else will receive the equivalent of a pizza. For some it will need to be a frozen pizza at the supermarket. Others will get a nicer one, maybe even a supreme pizza loaded with toppings. But only the super wealthy get a Porsche.

About 1,000 Arizonans earn $5 million or more a year. On average they will save $200,000 under the 2.5% flat tax, seeing their tax bill sliced from $450,000 to $250,000 based on GCI’s analysis. That same amount could fund 3,000 new ongoing teaching positions in underserved communities.

By contrast the median tax filer will save $10 according to the Joint Legislative Budget Committee, enough to buy a pizza. The bottom half of tax filers, 1.5 million filers, will in total receive $15 million.

1,000 Porsche 911s v. 1.5 million pizzas

$206 million v. $15 million

Gov. Doug Ducey has touted “the average tax cut as $300.” Referencing the average tax cut deflects from the miniscule tax cut that most tax filers will receive. It completely misrepresents this massive redistribution of state funds away from preserving “public peace, health, or safety, or for the support and maintenance of the departments of the state government and state institutions,” and to the wealthiest individuals in the state. Those with incomes exceeding $500,000 receive nearly half of the $1.4 billion tax reduction from the 2.5% flat tax, while those with incomes below $100,000, who represent 80% of tax filers, receive less than 10%.

Given the huge inflow of $78 billion in federal COVID relief monies to the state since 2020, and massive rise nationwide in corporate profits in 2021, the state’s fiscal situation this year is sound, even as this ruling will cost the state $1.4 billion in ongoing revenues. But it represents missed opportunities to make key investments, and it will put the state in a more perilous situation during future economic downturns.

While Arizona is in a stronger initial position than was Kansas when it adopted a significant reduction in its personal income tax rates in 2012, the decrease in Arizona state revenues will be proportionately greater than what Kansas pursued. And like Kansas, the promised economic rewards are vastly overstated. Kansas immediately had a fiscal crisis. A fiscal crisis may well come to Arizona as a consequence, but even if that is averted, critical investments have been foregone.

Gov. Ducey justifies this massive act of reverse Robin Hood, stating “We wanted to return those [dollars] to the citizens of Arizona who created the dollars in the first place.” For most tax filers, that contribution is only worth a pizza in Ducey’s view.

Meanwhile, schools in Arizona remain underfunded, at-risk children won’t see the needed investments to make their families more secure, and the state’s housing affordability crisis will remain unaddressed.

The building blocks of economic prosperity rely on these foregone investments.

But for the precious few, a new Porsche 911 has arrived.

Contact: Dave Wells, DWells@azgci.org, (602) 595-1025 ex. 2.

Dave Wells holds a doctorate in political economy and public policy and is the Research Director for the Grand Canyon Institute.

The Grand Canyon Institute, a 501(c) 3 nonprofit organization, is a centrist think tank led by a bipartisan group of former state lawmakers, economists, community leaders, and academicians. The Grand Canyon Institute serves as an independent voice reflecting a pragmatic approach to addressing economic, fiscal, budgetary and taxation issues confronting Arizona.

The Grand Canyon Institute (GCI) is dedicated to informing and improving public policy in Arizona through evidence-based, independent, objective, nonpartisan research. GCI makes a good faith effort to ensure that findings are reliable, accurate, and based on reputable sources. While publications reflect the view of the Institute, they may not reflect the view of individual members of the Board.

Grand Canyon Institute

P.O. Box 1008 Phoenix, Arizona 85001-1008