Budget

Budget

State Budget: Eliminating Progressive Income Tax Yields Structural Deficit

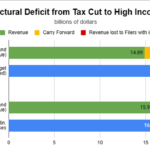

January 8, 2024As Gov. Katie Hobbs presents here State of the State address today in the background are the results of the largest individual income tax cuts enacted during the pandemic in the country. The Center for Budget and Policy Priorities estimates that the elimination of the progressive income tax in Arizona will cost the state $2.25 billion in revenue in FY 2024, the highest per capita loss in the country, and has created a structural deficit.

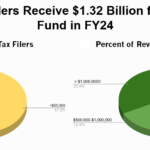

Where the revenue has a simple answer: lawmakers in their 2021 session during the Ducey Administration decided to dramatically lower income tax rates for wealthy people. The Grand Canyon Institute has referred to this as pizzas and Porsches—most tax filers will save enough to buy a pizza-so may not even realize their income taxes changed, while the most wealthy will save enough to buy a Porsche. Seventy percent of the total value of the tax cut enacted with Arizona’s 2.5% flat tax rate benefitted those with incomes of more than $200,000. Less than 10% of the total value of the tax cut went to the vast majority of Arizonans who earn less than $100,000. This is the impact of replacing a progressive income tax rate structure ranging from 2.59% to 4.5% with one tax rate for all Arizonans.

The structural deficit would disappear if the tax revenue from families with incomes exceeding $200,000 were not foregone. Instead we will likely see pushes for a series of budget cuts because for FY25 $1.4 billion has already been allocated to filers with an income exceeding $200,000. Ideally, the legislature would at least refer that issue back to voters as the state continues to have real fiscal needs.

About

Dave Wells holds a Ph.D. in Political Economy and Public Policy and is the Research Director of the Grand Canyon Institute. He can be reached at dwells@azgci.org or (602) 595-1025 ext. 2.

The Grand Canyon Institute (GCI) is a nonpartisan, nonprofit organization dedicated to informing and improving public policy in Arizona through evidence-based, independent, objective, nonpartisan research. GCI makes a good faith effort to ensure that findings are reliable, accurate, and based on reputable sources. While publications reflect the view of the Institute, they may not reflect the view of individual members of the Board.

Grand Canyon Institute

P.O. Box 1008

Phoenix, Arizona 85001-1008

GrandCanyonInsitute.org