Budget

Budget

State Budget: Where the Revenue Went

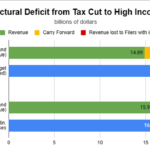

October 16, 2023Last week, the Joint Legislative Budget Committee identified structural deficits for Arizona’s future state budgets approaching half a billion dollars. Given the flush budgets of the last few years, Arizonans should wonder where the revenue went.

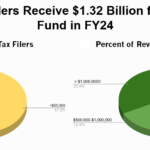

Where the revenue has a simple answer: lawmakers in their 2021 session during the Ducey Administration decided to dramatically lower income tax rates for wealthy people. The Grand Canyon Institute has referred to this as pizzas and Porsches—most tax filers will save enough to buy a pizza, while the wealthy will save enough to buy a Porsche. Seventy percent of the total value of the tax cut enacted with Arizona’s 2.5% flat tax rate benefitted those with incomes of more than $200,000. Less than 10% of the total value of the tax cut went to the vast majority of Arizonans who earn less than $100,000. This is the impact of replacing a progressive income tax rate structure ranging from 2.59% to 4.5% with one tax rate for all Arizonans.